The economics of a stronger dollar offer mixed blessings. On one hand, a stronger dollar means that foreign goods are less expensive which benefits consumers and, for example, travelers who visit countries with weakened currencies. It can help companies too, particularly those that import a great deal of their production and raw materials used for building products and hardware. As input and production costs fall, a company stands to boost their net margins (assuming sale prices and volumes, at the very least, stay constant).

But, that’s where a problem arises. Sale prices have been stagnating given very low levels of global inflation, waning global demand and China’s surprise yuan devaluations. Also, volumes are being compromised as most foreign transactions are settled in dollars so a foreigner has to use more of their home currency to purchase those goods. When you combine all these competing macro forces, at net, it’s a headwind for technology companies.

Feeling the Pinch, But Not Getting Crushed

In 2015, U.S. information technology companies generated about 60% of their sales from overseas, compared to 48% for companies in the broader S&P 500 index. It follows that technology company earnings are more sensitive to global macro forces, like falling global demand and the impact of a stronger dollar.

A closer look at a few technology companies underscores this pressure. Apple Inc., for instance, generates about 66% of its revenue from outside the U.S. and, in its earnings statement, said that the stronger dollar had cost it nearly $5 billion in Q4 2015 earnings. If the dollar hadn’t strengthened as much as it did, Apple said it would have posted $80.8 billion in Q4 revenue versus the $75.9 billion it actually reported. So influential was the pressure of the stronger dollar that they said $100 of revenue in September of 2014 was worth only $85 in December 2015. Without a stronger dollar, year over year revenue increase for the quarter would have been a solid 8%. Instead, it was only up 2%.

Microsoft revealed a similar outcome. In their most recent earnings statements, they indicated that the strong dollar had reduced its revenue by about $1.9 billion in the period ending December 2015. IBM estimated the negative impact to be around $1.5 billion. Oracle said the strong dollar cost them about $540 million. Alphabet (Google) went further and said that the impact was $1.3 billion in Q4 and that was on top of the $1.1 billion hits it took in Q1 and Q2. The list goes on.

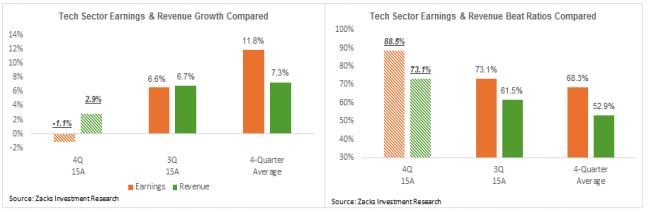

The headwinds find their way into earnings. To date, total earnings for the 26 Technology sector companies that have reported results (57.1% of the sector’s market cap) are down -1.1% on +2.9% higher revenues, with 88.5% beating EPS estimates and 73.1% beating revenue estimates.

As you can see in the charts below, this is weak growth relative to other recent periods but it has nevertheless been better than expected. Additionally, Apple hasn’t been a big influence in the sector’s growth picture, of late, with earnings and revenue growth rates for the company barely in the positive territory.

When all is said and done, Tech earnings are expected to be down -1.3% on +1.0% higher revenues, with strength in the software/internet spaces offset by weakness in the hardware and semi-conductor industries. For the Telecom space, we see strong double-digit earnings growth among the service providers (AT&T and Verizon) and weak growth among the equipment makers. It’s a mixed bag out there and investors have to be very selective in their technology selections especially as we enter the late stages of the business cycle.

Bottom Line for Investors

The Technology sector isn’t suffering Energy sector-like woes – in my view, it’s not headed for an earnings recession even in the face of a stronger dollar. Sales outlooks are softening and Technology companies are largely on the expensive side, so it’s important for investors to be highly selective in choosing tech stocks for their portfolios. We’re maintaining a market neutral weighting for information technology with rising interest in semiconductors, a neutral look at computer software services and a largely negative view of hardware and electronic components.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.