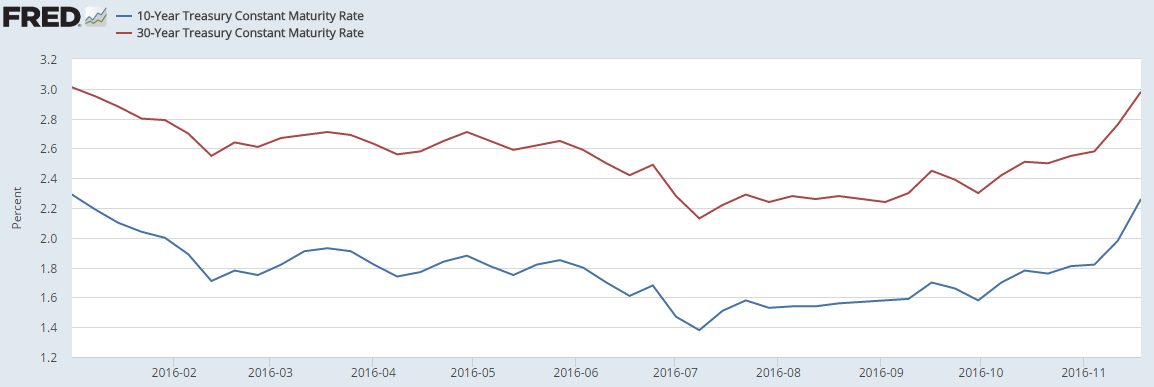

U.S. Treasuries have sold off sharply since the November 8 election. The 10-year U.S. Treasury went from 1.88% on November 8 to 2.14% on November 18, and the 30-year saw a similar spike in yields from 2.63% to 3.01% over the same period. With interest rates so low, these may just seem like incremental upticks, but in reality, they represent large percentage increases over a short period of time. So, what do we make of them?

Source: Federal Reserve Bank of St. Louis

There are a few different reads for the spike in yields, but the most compelling have to do with rising inflation expectations tied to President-elect Donald Trump’s proposed policies. Without diving into the details, the high-level expectation is that Trump’s policies will take aim at lower taxes and higher government spending, both of which will put upward pressure on prices – especially given that the U.S. economy is already close to full employment and the consumer is in good health.

The extension of that argument would also factor-in a more protectionist trade stance, where tariffs are used more frequently and free trade and movement of labor are more restricted. If corporations have to onshore some of the labor and production capabilities back to the U.S., it will more than likely lead to rising cost of production and therefore rising the cost of goods.

A common and enlightening example is to think about the Apple iPhone. Making a single iPhone involves production components from South Korea, Taiwan, Japan, Italy, the United States, and China. The supply chain is not as simple as “made in China.” If Apple has to create all of these factories and processes here domestically, the cost and price of an iPhone will almost certainly rise. Again, rising prices equate to rising inflation, and bond traders demand higher yields when inflation expectations are up.

Inflation’s Connection to Bond Yields

A common question I get from investors is: what does ‘inflation expectation’ have to do with bond yields? It’s easy – let’s say you purchase a 10-year U.S. Treasury that pays 2% annual interest. Then let’s say the economy heats up, spending rises, and the cost of goods starts trickling up (inflation). All of a sudden, your 2% is not necessarily keeping up with rising inflation, and you’re losing money on your bond. What do you do? You demand a higher interest rate! The market by nature anticipates changes – changes in earnings, changes in prices, changes in policy. If the market senses that prices are due to rise in the coming years, bond yields will go up because investors will demand compensation now for rising prices later. That, in my view, is what we’re seeing right now.

Bottom Line for Investors: Don’t Forget about the Yield Curve

The media likes to make a fuss about rising interest rates, but the story that very few people are telling is the effect on the yield curve. As longer-term interest rates rise, the yield curve gets steeper – and a steeper yield curve portends more favorable growth conditions. Since banks borrow money at the short end of the yield curve (at rates essentially set by the Federal Reserve) and loan it out at longer term rates, the steeper the yield curve the higher their net interest margins. If banks are more profitable, they’ll lend more, and more lending activity drives economic activity. Assuming that Trump also pursues loosening financial regulations under Dodd-Frank, it’s essentially a double (positive) whammy for banks.

To be sure, the Federal Reserve may tighten monetary policy as fiscal spending rises and inflation starts to set-in, but it is our view that their rate hikes will be very gradual and not fast enough to flatten the yield curve. A yield curve that remains upward sloping and steepens in the near to medium term would be bullish in our opinion, and I think that’s what we’re likely to see in the next 6 – 12 months.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.