Most investors understand that there are no certainties when it comes to equity investing. We can never know for sure whether a stock or an index will go up or down from one day to the next, or where it will move over the next month or the next year. At Zacks Investment Management, we have been developing tools over the past decade to help us make decisions we think will give us the highest probability of success (which has in turn brought us a lot of success over the years). Even so, no investor can be fully certain their decision will be the optimal one – it’s impossible.

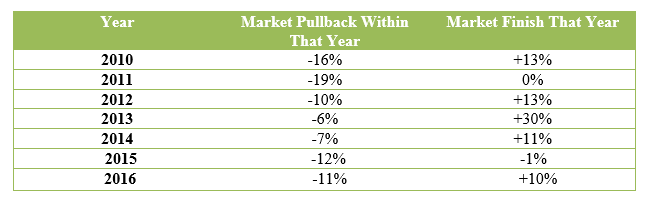

So, where am I going with this? While there are no certainties in stock market investing, there are patterns that emerge often enough that we can recognize them and make informed investment decisions accordingly. There are several examples of these patterns: bull and bear market cycles, small-caps tending to outperform early in bull markets, large-caps faring better in later stages, defensives holding up during market declines. And so on. The pattern I’m writing about in this column is the one that investors still grapple with a great deal: market corrections.

Stock market corrections are generally defined as short, sharp (and often scary) declines in the 10 – 20% range over a period of less than six months. Few investors enjoy corrections (why would they?), and in many cases they can lead to emotional knee-jerk reactions that adversely affect long-term returns. An investor fearful that a correction may in fact be the next big bear market may sell stocks into the decline, and then get whipsawed when stocks suddenly and convincingly recover.

Here are some examples of how this might occur:

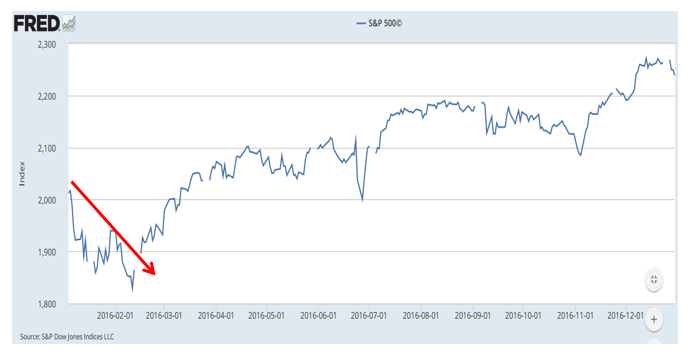

At nearly this exact time last year, an investor allocated fully to stocks would have checked their portfolio only to see it down 11% year to date – in just over one month’s time! Not good, and probably gut-wrenching for many.

In 2016, the Market Pulled Back Early and Sharply

Source: S&P Dow Jones Indices LLC

Not only did the market pull back rather violently, investors were also made to deal with headlines about China’s economic hard landing and a potential currency war. With negative headlines coupled with declining markets, it’s understandably easy to believe that it’s time to run for the hills. The same could be said of Brexit later in the year, when many feared that it was the beginning of the end for Europe and perhaps the global economy.

But in 2016 as in just about every other year cited above, the wise decision would have been to stay cool and to stay the course. If fundamentals argue that stocks and the economy are on solid footing, then often times everything else we hear is just noise. And the key is to invest on news, not noise.

Bottom Line for Investors

The issue that often troubles many investors – and ultimately hurts them – is that they let volatility increase their temptation to “time the market,” allowing short-term uncertainties to drive their decision-making. But, it’s important to remember that volatility works both ways. Rapid declines are often followed by rapid recoveries, and the last several years of this bull market have been categorized by just that. When an investor gets caught up in the negative news stories and sells into the downside of a correction, it often means capturing the losses but failing to participate in the recovery, which is a recipe for sub-optimal returns over time. Often times, it is better to just stay the course.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.