You’ve likely heard that consumer spending accounts for 70% of U.S economic activity. While some argue with this figure and how it is derived, there is still no denying that consumer spending has a notable impact on the economy.

So, what happens when retailers take a big hit like many did in Q1? Does it mean that the consumer is tapped out and potentially taking the economy down with it?

A look at some of the data and announcements from Q1 could lead one to believe that a downturn is near. Here are some of the retail industry announcements you may have read about:

- Wal-Mart is set to close 269 stores, including 154 in U.S.

- K-Mart is expected to close more than two dozen stores over the next few months

- C. Penney plans to permanently shut down 47 stores (after closing 40 stores in 2015)

- Macy’s reported Q1 sales fell 7% year over year with earnings diving 29% over the same period; they plan to shut down 36 stores and lay off ~2,500 employees

- Aeropostale filed for bankruptcy and is in the process of closing 84 stores nationwide

- Kohl’s reported earnings fell some 50%

The list goes on (and on). With the economy expected to post only modest growth on the year, and consumers appearing reluctant to spend, the question on investors’ minds is: should they underweight or eliminate retail/consumer discretionary exposure in portfolios? Or, does retail weakness signal an outright recession is around the corner?

In my opinion, none of the above. There is one simple, but important, fact to keep in mind—the way consumers spend has changed. We, myself included, are now less likely to make the trip to a department store or traditional brick and mortar retailer and are more likely to shop online.

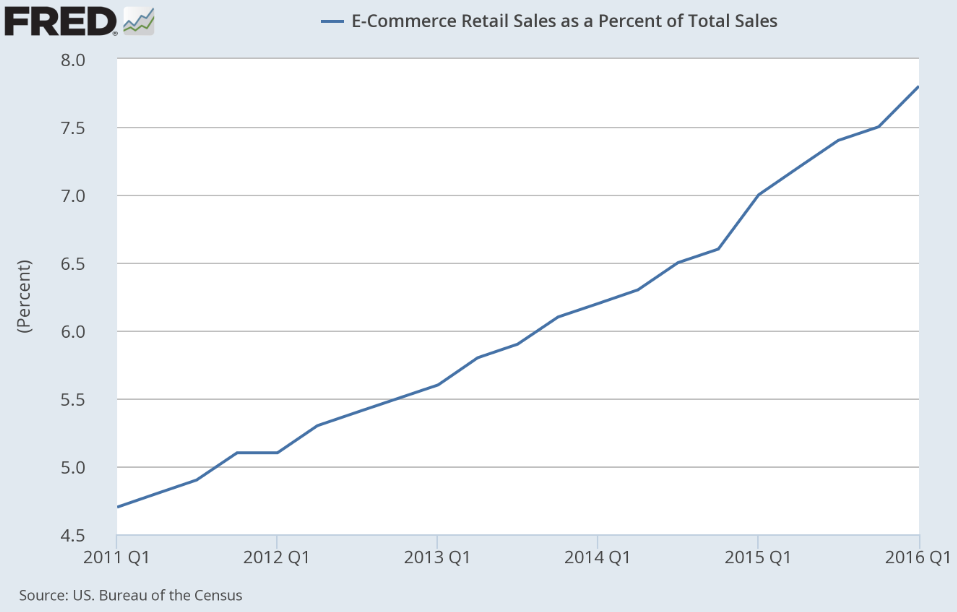

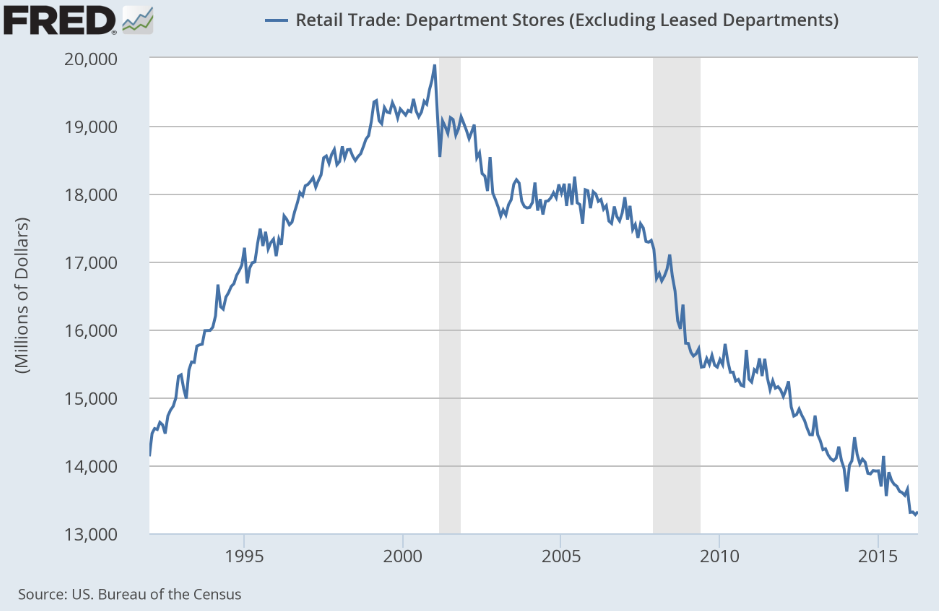

These two charts tell the story clearly. You can see that e-commerce spending is on nearly a straight line to ‘the moon,’ while retail sales at department stores has been on the decline since the 2000 tech bubble (which is also when e-commerce emerged). The tradeoff is logical.

Source: U.S. Bureau of the Census

Source: U.S. Bureau of the Census

If you look again at the Q1 retail announcements above, you’ll notice that most of the names mentioned are traditional big box retailers. These are good companies, but they’re also ones that got a later jump into the world of e-commerce. Each one of their earnings outlooks depends highly on how well they can adjust their business models to attract the online consumer.

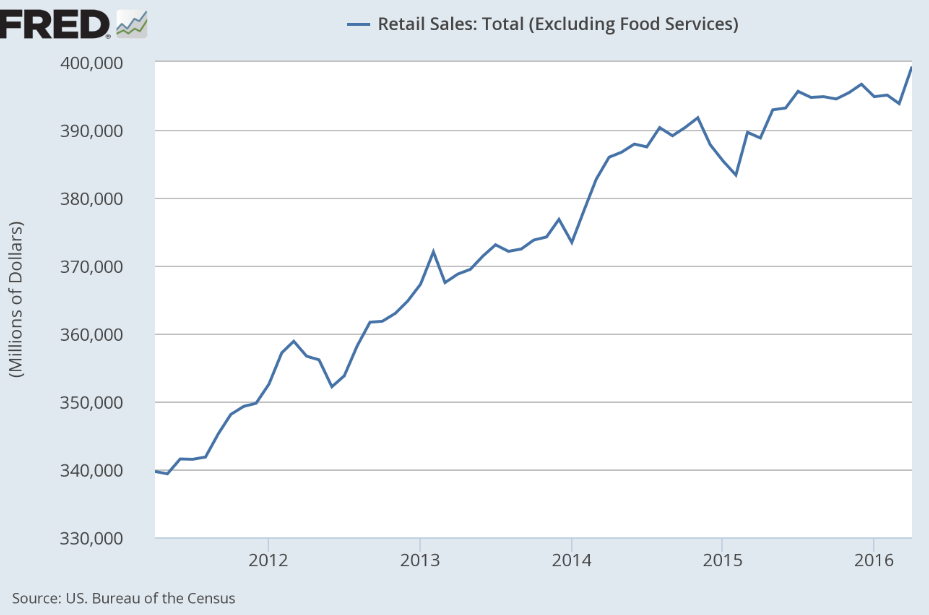

Total Retail Spending Remains Strong

Big box and department store retailers aside, consumer spending is actually strong. In April, the U.S. consumer increased the pace of spending at the fastest rate in a year, with overall sales rising 1.3% month over month. But here’s the kicker: of those total sales, Internet and catalog sales have grown more than three times as fast as overall sales, up 10.2%. Department-store sales, not surprisingly, fell 1.7% over the past 12 months.

Source: U.S. Bureau of the Census

The cutbacks from retailers that look worrisome on paper—with store closures and layoffs— are actually companies coming to terms with the fact that consumers are increasingly purchasing online. Following that, it makes less business sense to have physical retail locations. Better to part with those stores and allocate resources to nurturing more formidable e-commerce programs.

Bottom Line for Investors

Many headlines warned of a “retail recession” as earnings numbers from players like Gap, Nordstrom and Kohl’s all disappointed greatly to the downside. But, all it took was a more detailed look at the sector as a whole to realize those sales weren’t disappearing—they were just being redirected. Case in point, Amazon absolutely destroyed Q1 earnings reporting $1.07 earnings per share versus the expected $0.61; this was on revenues of $29.1 billion versus the expected $27.9 billion. Therefore, while on paper there seems to be cause for worry in the retail sector, the U.S. consumer is strong and is simply evolving with the new e-commerce movement.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.