There’s no sugar coating it – the S&P 500 has been far from impressive over the last three quarters. Sure, the Energy drag has been seismic and resource-sensitive sectors like Materials and Industrials have also taken it on the chin. Still, Zacks Investment Management is seeing notable weakness in other sectors as well which is painting a broader picture of “muddle-through” growth for the U.S. economy.

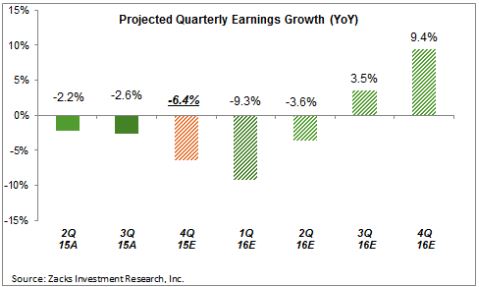

We now have three quarters of back-to-back negative earnings growth and this picture isn’t expected to change in the current (Q1) and following (Q2) periods either. In fact, the entirety of 2016 earnings growth is nowexpected to come during the second half of the year, with growth likely to be negative during the first six months.

This isn’t ideal for stock prices and will likely weigh on them. Read: volatility will be the norm for 2016, not the exception. But, the earnings weakness is not exactly shocking news and it does not change our 2016 outlook for the economy and stocks. We still see modest growth for the U.S. (less than 3%) and think stocks will post modest single digit returns for the year. Keep in mind – stocks still have higher yields than bonds or cash and we see the risk of recession as low. You want to own stocks in that kind of environment, in my view.

Earnings growth is still likely to be positive, on balance, for the year which would support higher stock prices. Estimates for 2016 have softened recently with total earnings for the S&P 500 index currently expected to be up only +2.1% from the same period last year. This is down from expected growth of close to +8% at the beginning of the year. What’s different this year (and last) is the removal of QE in the U.S. which has dried up a source of liquidity that nudged investors further out onto the risk curve. In other words, the era of multiple expansion in this bull market is probably behind us. The focus is on earnings and the growing skepticism is good. It gives room for upside surprise.

So What Happened to Earnings, and Why be Hopeful?

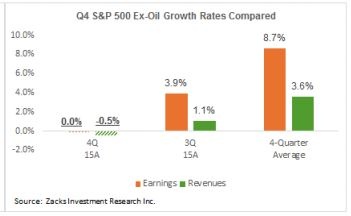

We now have Q4 results from 490 S&P 500 members that account for 98.9% of the index’s total market capitalization. Total earnings for these companies are down -6.4% from the same period last year on -4.6% lower revenues with 64.4% beating EPS estimates and 44.2% coming ahead of revenue estimates (beats were in-line with historical averages). Energy continues to be the big drag, with total earnings for the sector expected to be down -77.5% from the same period last year on -35.2% lower revenues. Strip away Energy, and earnings growth was flat for the S&P 500.

Zacks Investment Management believes earnings improvement for the second half of 2016 will likely result from the anticipated end to the Energy sector’s “drag” based on consensus expectations of a stabilization in oil prices. We’re already seeing incremental signs of stabilization occurring with crude prices heading back toward $40 recently. It’s too early to call this an outright stabilization, but the picture is starting to look better (though do continue to expect price volatility for crude).

When we break S&P 500 earnings down by sector, it’s plain to see the profound strain that resource-intensive sectors are placing on aggregate earnings. Basic Materials (-23.4%) and Industrials (-17.2%) have taken a beating as well – the adjustment period for rapidly falling commodities prices has been tough.

Finance and Technology earnings have been soft, but better than the street’s expectations. Q4 earnings in the Technology sector are expected to be down -1.2% on -2.0% lower revenues with strength in the software/internet spaces offset by negatives in the hardware and semi-conductor industries. For the Telecom space, which is part of the Zacks Tech sector, we see strong double-digit earnings growth among the service providers (AT&T and Verizon) and weak growth among the equipment makers.

Margins are Still Good

Margins follow a cyclical pattern – they expand as the economy emerges from a recession and companies use existing resources in labor and capital to drive business. But, eventually, capacity constraints kick in forcing companies to spend more for incremental business. At that stage, margins start to contract. We may not be at the contraction stage yet – as you can see margins have stayed level for about a year now – but the optimistic assumptions about productivity improvements have to pan out for current consensus margin expansion expectations to stick. Something to watch.

Bottom Line for Investors

Soft, disappointing earnings reports gave investors one more reason to fear the correction might be a bear market. While this is a possibility, I just don’t see this as a likely. The selling pressures have reset many strong companies with solid earnings into lower multiples and, I think in many cases, investors have priced-in the possibility of flat earnings all year without a back half recovery. This is also evident in rapidly declining expectations where consensus saw 8% earnings growth at the beginning of the year and that number has now dropped to 2%. The best thing we can hope for is an earnings surprise in the back half of the year, and I think we’ll get one.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.