Zacks Investment Management provides insight into the biggest news stories, and key factors that we believe are currently impacting the market such as:

- The hot U.S. jobs market

- Possible softening of a recession

- Status of the housing market

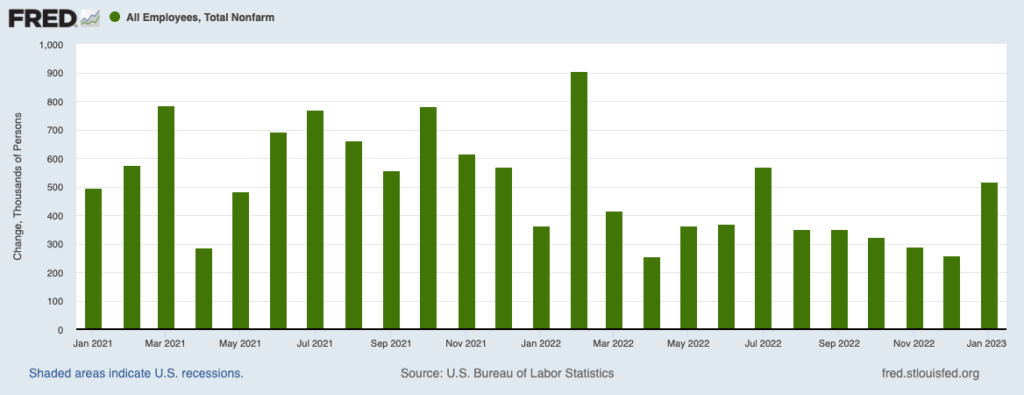

The U.S. Jobs Market is Still Too Hot for the Fed – The U.S. labor market surprised just about everyone in January (including the Federal Reserve!), with nonfarm unemployment jumping by 517,000 for the month. The average expectation for payroll growth in January was a little over 200,000, which the jobs market blew past.1

How Does Today’s Market Affect Your Investments?

To better navigate through the market’s ups and downs, it’s important to be prepared for both the good and bad. In our latest Market Strategy Report, we look at fundamental and sentiment drivers that could weigh on the sector in the next bull market. We also take a look at:

- Will Technology Lag in the Next Bull Market?

- Earnings Estimates Have Fallen – But Have They Fallen Enough?

- Bottom Line for Investors

If you have $500,000 or more to invest and want to learn more, download your guide today!

Download Our Exclusive “Market Strategy Guide”3

To be fair, January can be a quirky month for data given seasonal adjustments, weather, and other factors. But absent a major error in reporting, it’s fair to say the labor market remains piping hot – which continues to be a problem for the Fed. While it’s true that high-profile companies, particularly in the tech sector, have been announcing layoffs over the past few weeks, it is clear that this appears to be more a byproduct of over-hiring during reopening following the pandemic than an indication of broad economic weakness. Following the payroll report, the unemployment rate fell to a new 50-year low of 3.4%. A strong jobs market frustrates the Federal Reserve, since too little slack implies the possibility – or perhaps likelihood – of upward pressure on wages. The good news from last week’s report, however, was that wages grew by just 0.3% month-over-month in January, with the 12-month growth rate falling from 4.8% to 4.4%. The Fed remains wary, particularly given Chairman Powell’s allegiance to the Phillips Curve, which states that inflation and unemployment have an inverse relationship.

States are Reporting Healthy Cash Reserves – The U.S. economy remains a mixed bag, with weakening activity in spending, manufacturing, and services largely being neutralized by the strong labor market described above. One bright spot that could help the economy weather a downturn: state finances. Unlike the federal government, state and local governments have an obligation to balance their budgets every year, which means they must account for higher spending with higher revenues or adjust spending downward in years when tax revenue is weaker than expected. When tax revenue falls, it often means states need to make spending cuts and/or lay off workers, which often makes a downturn worse. In 2023, however, with a possible recession looming, most states are heading into the new year with record-high reserves and ‘rainy day funds.’ According to the National Association of State Budget Officers, states have approximately $136.8 billion stashed in reserves, which is up from 2021’s levels. States benefited from a swift recovery when the economy reopened following the pandemic, and also from an increase in federal government spending which was distributed to the states. This has put states in a strong position to weather a downturn, if one were to occur. According to Moody’s Analytics, 39 states have the reserves they need to offset lost revenue in a mild recession.4

Has the U.S. Housing Market Stabilized? 2022 was a challenging year for the U.S. housing market, following two historic years of price appreciation and sales activity. With prices pushing some 40+% higher over a two-year period, many homes started to become unaffordable when mortgage rates more than doubled from 3% to over 7%. The market has experienced some respite so far in 2023, however, as mortgage rates have come down by a full percentage point in anticipation that the Federal Reserve will end its monetary tightening campaign in the first half of the year. Mortgage applications have gone up by about 25% since the end of last year, and Redfin reports that more real estate agents are being contacted relative to a lull seen late last year. Another key data point – pending home sales – also rose 2.5%, which tends to be a leading indicator for the housing market.5

Will Tech Stocks Roar Ahead in the Next Bull Market? – 2022 marked the worst performance for the tech sector since the tech bubble popped in the 2000-2002 period.

When will tech stocks recover? In our latest Market Strategy Report, we take a look at that question and fundamental and sentiment drivers that could weigh on the sector in the next bull market. We also take a look at:

- Will Technology Lag in the Next Bull Market?

- Earnings Estimates Have Fallen – But Have They Fallen Enough?

- Bottom Line for Investors

If you have $500,000 or more to invest and want to learn more, click on the link below to get your free report today!

Disclosure

2 Fred Economic Data. February 3, 2023. https://fred.stlouisfed.org/series/PAYEMS#

3 Zacks Investment Management reserves the right to amend the terms or rescind the free Market Strategy Report offer at any time and for any reason at its discretion.

4 Wall Street Journal. February 5, 2023. https://www.wsj.com/articles/states-are-flush-with-cash-which-could-soften-a-possible-recession-11675544984?mod=djemRTE_h

5 Wall Street Journal. February 6, 2023. https://www.wsj.com/articles/housing-market-shows-signs-of-thawing-11675617472?mod=djemRTE_h

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Market Strategy Report offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.