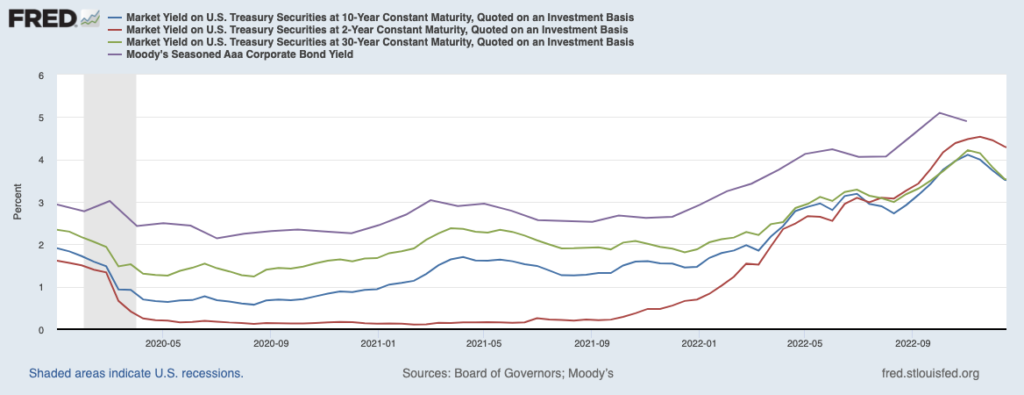

U.S. Treasury bond yields have been moving briskly higher across the duration, and generally, safe investment-grade corporate bonds have also been paying more attractive yields. The chart below shows that investors can fetch at least a 3.5% risk-free yield in the current marketplace, which has many wondering if bonds are a better bet in these uncertain economic times.1

Bond Yields Have Gone from Near Zero to Relatively Attractive Levels

The outlook for bonds is certainly different than it had been in the previous decade. Following the 2008 Global Financial Crisis, virtually every type of bond yield marched lower, which made stocks highly attractive by comparison. Corporate profitability was also growing alongside the economic recovery, which resulted in sizable outperformance for U.S. equities relative to U.S. Treasuries and other categories of bonds. The relative performance of stocks to bonds reached new peaks in 2021, even higher than those reached in the late 1990s.

Today looks different. Across the U.S. Treasury bond yield curve, investors can earn a risk-free 3.5%+ yield. In the investment grade corporate bond realm, yields are approaching 6% and also have low levels of refinancing risk in a rising rate environment. Compared to the S&P 500’s current dividend yield of 1.7% and a cyclically adjusted earnings yield of approximately 4%, there’s a meaningful case for rethinking bonds’ role in a diversified portfolio.

Another factor to consider is how bonds and stocks perform in rising interest rates and inflationary environments. For U.S. bonds, rising rate environments in recent history have meant fairly benign returns, as seen in the table below:

| Periods of Rising Rates | U.S. Bond Market Return |

| February 1994 – February 1995 | 0.01% |

| June 1999 – May 2000 | 2.11% |

| June 2004 – June 2006 | 3.09% |

| July 2012 – December 2013 | -0.17% |

| December 2015 – December 2018 | 1.89% |

It’s also true, however, that regular coupon payments and the ability to reinvest in higher-yield bonds as interest rates rise can boost the total return of a fixed-income portfolio over time, but getting this right requires active management. This opportunity in fixed-income is currently top-of-mind for our fixed income portfolio managers at Zacks Investment Management.

Stocks also require active management in a rising rate environment, in my view. Since higher interest rates can reduce the value of future earnings – while also raising the cost of capital companies need for investment and growth – certain types of stocks can face headwinds in this type of environment.

The stocks that tend to get hit the hardest are ones with elevated P/E ratios and growth companies with low net income, even if they enjoy rapid top-line revenue growth (see: tech in 2022). These are also companies that generally could experience higher debt costs, particularly if they have to roll over debt in a rising rate environment. Higher debt costs can of course compress profit margins, which is not good for earnings outlooks. This is also why value stocks – which tend to have stronger cash flow and balance sheet profiles – tend to be favored in economic slow patches and rising rate environments.

As for inflationary environments, stocks have tended to outperform fixed income over longer periods when prices are rising. This is particularly true for stocks that can pass along rising costs to consumers in order to preserve profit margins. Again, value stocks are favored here, as many companies in the value space have pricing power, stable earnings, and low debt.

Bottom Line for Investors

I certainly do not disagree that there is a strong case for rethinking bonds’ role in a diversified portfolio. Even when bond yields were low in the years following the 2008 Global Financial Crisis, bonds offered non-correlated performance to stocks (generally speaking) to help reduce volatility and create balance.

Today, bonds can offer relatively competitive returns to stocks, which I think only adds to the case of including fixed income in a portfolio particularly if an investor is interested in income and lower overall volatility. But for investors focused on long-term growth, I think it’s a stretch to say that we’re entering a paradigm shift where bonds should replace stocks in a portfolio because economic growth is expected to slow considerably for the foreseeable future.

At just about every turn in history, the world has produced an innovation or productivity engine that has driven growth and spending forward, and equities are the most effective way to capture that new value creation, in my view. U.S. equities have also endured a bear market in the last year, which means that if history is any indication, forward expected returns are higher than they were before. If the case for bonds is growing, it’s important to keep in mind that the case for stocks is growing, too.

Disclosure

2 Fred Economic Data. December 16, 2022. https://fred.stlouisfed.org/series/DGS10#

3 T. Rowe Price. 2022. https://www.troweprice.com/content/dam/iinvestor/images/HardCd_dwnld_UnderstandBondsRisingRate02282019.pdf

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The ICE Exchange-Listed Fixed & Adjustable Rate Preferred Securities Index is a modified market capitalization weighted index composed of preferred stock and securities that are functionally equivalent to preferred stock including, but not limited to, depositary preferred securities, perpetual subordinated debt and certain securities issued by banks and other financial institutions that are eligible for capital treatment with respect to such instruments akin to that received for issuance of straight preferred stock. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.