There are a few trends shaping-up simultaneously in debt markets that are worth keeping a close eye on. I’ll cut right to the chase because this is important: if these trends continue as-is, history tells us a recession is likely in the works. That’s why investors need to keep checking-in regularly on the issues I’ll review below.

index – a key measure of inflation – declined by -0.1% in May, its largest drop in 16 months. Expectations were for a 0.2% increase. In all likelihood, longer-term U.S. Treasuries are probably falling because of both factors.

Whatever the cause, the outcome is that shorter-term interest rates are rising as longer-term interest rates are falling. As the spread between long and short rates narrows, the yield curve flattens. And as the yield curve flattens, net interest margins for banks start to get squeezed. That can lead to less lending which can ultimately choke-off growth.

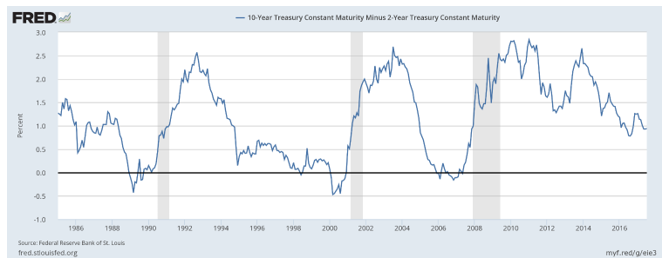

Readers can see this clearly in the chart below. Notice how each time the line dips below zero – which is when shorter-term interest rates dip below longer-term rates – a recession hits just a short time later. You can look back in history and see evidence of this cause-and-effect over and over.

The Spread Between 10-Year U.S. Treasuries and 2-year Treasuries is Shrinking

At Zacks Investment Management, we have made changes to our fixed income strategy in anticipation of the changing interest rate environment. Without going into too much detail here, we continue to favor corporate and municipal bonds for investors searching for income and diversification. And as always, review of credit quality remains utmost in our selection methodology. If you want to learn more about our fixed income approach and what we’re doing now, please do not hesitate to reach out to one of our Investment Advisor Representatives at 1-888-600-2783. Now is a good time, in my view, to review your fixed income allocation.

Corporate Debt Also Matters

In the high yield space, investors should be looking for the opposite of what you look for in the Treasury/risk-free space. For corporate bonds, you want to watch for widening spreads, which could be a harbinger for market corrections and volatility. Concern on this front has risen recently – high-yield spreads bottomed on March 2nd at 344 basis points, which may signify the start of a trend shift. Also at issue in corporate bond space are rising delinquencies. Corporate leverage sits at a 13-year high. We’ve seen rising delinquencies in a variety of sectors, including auto loans, consumer loans, and agriculture. Rising delinquencies in these areas have historically preceded recessions, much like an inverted yield curve.

Bottom Line for Investors

Some worrying trends are shaping up in the bond markets, but I do not think the alarm bells are ringing just yet. The yield curve is still upward sloping, and credit spreads are still within the norm. But early signs that the yield curve is flattening and that the credit cycle may be reversing course are extant, and investors need to keep a close eye. Feel free to lean on Zacks Investment Management at 1-888-600-2783 for any questions you have or if you think your portfolio needs to be adjusted as the environment shifts.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.