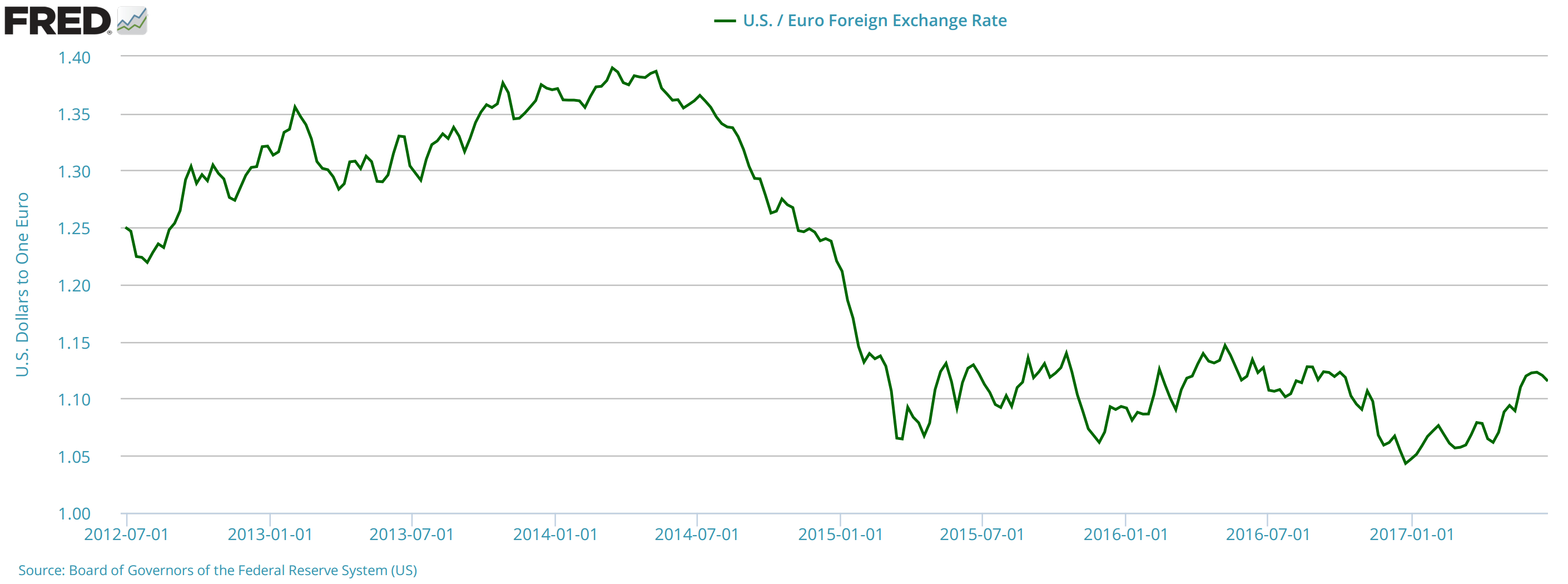

Readers who are retired and are interested in travel may want to look across the Atlantic to Europe. A confluence of two economic forces – low inflation and a weak currency – has made travel in Europe relatively attractive over the last few years. As European Union inflation has puttered higher (less than 2% on average) over the last five or so years, the euro currency has weakened against the U.S. dollar by some 20%. Simple napkin math will tell you what this means for Americans: your dollars can go a long way in Europe.

A Declining Line Means the Dollar is Getting Stronger in Europe

While I’d love to continue this column by writing more about where to go in Europe and what sights to see, this is not a travel column. So, let’s talk instead about the investment potential in Europe.

The Economic Case for Europe

A pure look at fundamentals makes a strong case for Europe. In the first quarter, exports grew by +1.2%, household spending was up +0.3%, and gross fixed capital formation (capex) jumped +1.3%, on the heels of a +3.4% surge in Q4 2016. Growth is coming in the right places, too – the capex increase was largely focused on economic strongholds like machinery & equipment, technology equipment, and construction & engineering.

Then there’s manufacturing, which has been a major strongpoint for Europe of late. Euro-zone manufacturing grew at its fastest pace for six years in April, while the corresponding index for the U.S. declined. PMI readings have been ripping since the turn of the year, and data from April and May suggest that as a result, the rate of GDP growth in Europe could accelerate further in the second quarter, rising to +0.75%.

A good way to think about Europe’s momentum is to remember that they are at a much earlier phase of their economic recovery than the U.S. While we are in our eighth year of expansion with an unemployment rate sitting at 4.5% and interest rates on the rise, Europe has barely nudged forward during that time and still has an unemployment rate hovering around 9.5%, with accommodative monetary policy still cranking ahead. There is arguably more pent-up consumer demand to accommodate in Europe and more spare capacity in businesses to meet it.

The monetary policy point is an important one. While the Federal Reserve sets-off on a path to ‘normalizing’ interest rate policy, the European Central Bank (ECB) is keeping its foot on the gas. In the same week that the Fed raised the fed funds rate by a quarter of a percentage point to 1.25%, the ECB decided that the interest rate on the main refinancing operations, the marginal lending facility, and the deposit facility would remain unchanged at 0.00%, 0.25% and -0.40% respectively. While Zacks expects one more rate increase this year from the Fed, the ECB has made it clear that they expect zero interest rate increases this year, even as they continue net asset purchases (quantitative easing).

In other words, if you follow the money, it leads you to Europe.

Bottom Line for Investors

Does a stronger Europe mean you should sell U.S. companies and buy European ones? Not necessarily. Remember that nearly half of S&P 500 sales come from abroad, a significant percentage of which come from Europe. Diversifying your portfolio to Europe could make sense, but it also stands to reason that owning large-cap U.S. multinationals could get you similar exposure – without the currency risk.

At Zacks Investment Management, we have both an international strategy and several large-cap strategies that can help investors gain exposure to Europe and other foreign markets with our managers at the helm. That means getting international diversification in your portfolio as well as our expertise, all at once.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.