In my column last week, I wrote extensively about the likely impact of China’s lockdowns on economic uncertainty and ongoing market volatility. April data coming out of China seems to confirm that view.

China’s government officials have doubled down on stamping out all Covid-19 infections, and it has sharply impacted economic activity. Retail sales fell 11.1% year-over-year in April, marking the biggest monthly decline since global lockdowns in March 2020. Industrial production also declined by 2.9% for the month, and fixed-asset investment – a proxy for business and government investment and spending – sank by nearly 3% from the previous quarter. The sizable auto sector has been particularly affected, with output plunging 43.5% in April on the heels of lockdowns in Shanghai and the Jilin province. Anecdotally, not a single car was sold in Shanghai last month.1

All told, GDP growth likely took a hit while China’s urban unemployment rate ticked up to 6.1%, almost reaching last February’s 6.2% level. In my view, the resurgence of downside equity volatility over the last few weeks has largely been in response to this economic weakness in China, coupled with uncertainty over how long and far the country will go in pursuing its zero-Covid strategy. Though the April data removed some of that uncertainty and allowed market participants to grasp the impact of China’s economic restrictions, it did not remove uncertainty over what the future could look like.

What’s more, the market seemed to expect China’s government and central bank to step in with stimulus packages designed to boost spending and growth, but so far that has not occurred. The People’s Bank of China refrained from cutting lending rates in a closely-watched meeting last week, though they did allow local banks to cut mortgage rates in an effort to support the real estate sector. China’s government has been largely silent about fiscal stimulus measures.

This situation in China is tenuous and seems set up for either a positive or a negative surprise. On the negative side, China could go even further and implement country-wide lockdowns, shutting down the economy almost entirely. On the positive, China could ease restrictions and move towards fully reopening, which is already the plan for Shanghai by June 1. The actual outcome remains unknowable here, but as I wrote last week, economic growth is far too vital to government stability in China, and signs are already pointing to the movement towards reopening versus further retrenchment. The scenario may be set up much like the U.S. economy did in 2020 and 2021 – when pandemic restrictions crimped growth but ultimately gave way to a sharp comeback when restrictions were phased out.

I continue to believe the neutralizing factor preventing a global recession is the United States. I realize it feels to many that the U.S. economy is in dire shape, particularly since inflation is visible in day-to-day life. But year-to-date, the economic data and fundamentals continue to tell a different, very underappreciated story.

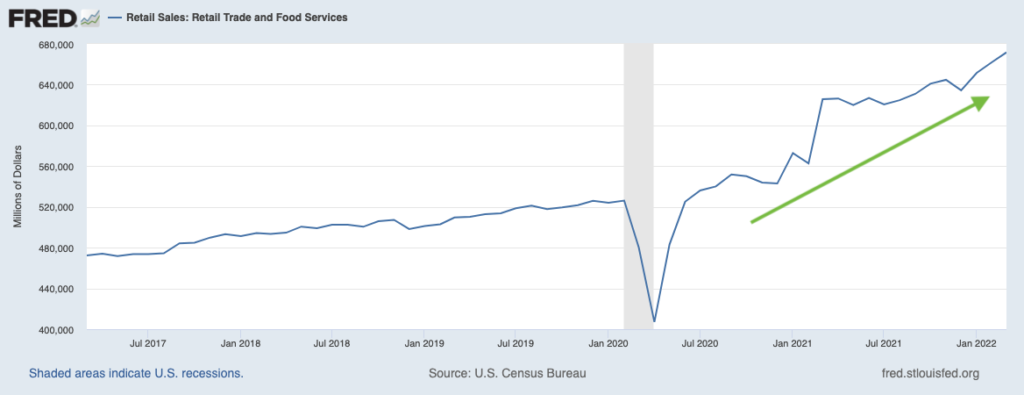

In April, for example, retail sales rose at a seasonally adjusted 0.9% from March, which means that spending has been on an uptrend for four months. This solid print followed a sizable upward revision to spending in March, which the U.S. Commerce Department said increased by 1.4% from February. Inflation is driving some of these figures higher, but it’s also true that consumers are still getting out into the economy and spending at healthy levels. Spending at restaurants and bars is up 19.8% from last year’s levels.2

Retail Sales Continue Rising at a Strong Clip

U.S. industrial production is also signaling a U.S. economy that is firmly in expansion mode. This metric measures factory, mining, and utility output, and in April it rose 1.1% from March. Factories are not only ramping-up production, but they are also scrambling to keep up with demand with capacity utilization at its highest level since 2005. Many factories wish they could find more workers, but the labor market remains extremely tight. April marked the 12th consecutive month of job gains. As I’ve said many times before, this is not the stuff of recessions.

Bottom Line for Investors

Let’s be frank: market volatility makes everything seem terrible. Wild swings in the market are often accompanied by a spate of negative news, making it very difficult for many investors to keep a steady hand. But now is a time to be patient and to avoid emotional decision-making.

Since 2002, over 85% of the best days in the market occurred after the worst days, which underscores the importance of not making any sudden moves in response to a big down day.4 If your portfolio’s asset allocation is aligned with your goals, now is the time to do nothing. If your goals have not changed, your asset allocation should not change, either.

Disclosure

2 Wall Street Journal. May 17, 2022. https://www.wsj.com/articles/us-economy-retail-sales-april-2022-11652734620?mod=djemRTE_h

3 Fred Economic Data. May 17, 2022. https://fred.stlouisfed.org/series/MRTSSM44X72USS#0

4 Wall Street Journal. May 17, 2022. https://www.wsj.com/articles/us-economy-retail-sales-april-2022-11652734620?mod=djemRTE_h

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.