Q2 earnings season is now in full swing, and there is arguably quite a bit riding on this quarter and this year’s earnings season, given the rather muted data seen in 2016 of +0.8% earnings growth on +2.1% higher revenues. The Energy sector was still largely to blame for last year’s fairly dismal aggregate earnings (a majority of sectors did just fine), but the optics of near zero earnings and revenue growth for a full year is a meaningful negative, particularly on sentiment.

2017 is supposed to be the year that the narrative turns around, with many market participants (including us) anticipating close to double digit earnings growth for the year. If S&P 500 companies fall short of that mark, it could have a serious impact on stock prices.

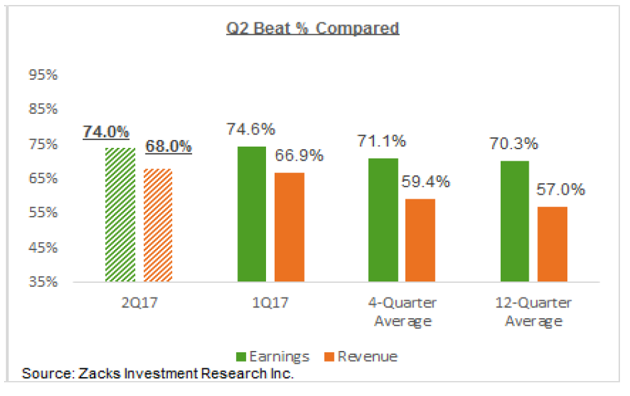

Fortunately, things appear to be nicely on track. With results from 350 S&P 500 members already out, total earnings are up +11% from the same period last year on +5.9% higher revenues, with 74% beating EPS estimates and 68% beating revenue estimates. For Q2 as a whole, combining the actual results with estimates for the still-to-come companies, total earnings are expected to be up +9.7% from the same period last year on +5.4% higher revenues. This would be coming after +13.6% earnings growth on +7% higher revenues in Q1.

You might be wondering if there’s cause for concern given that Q2 earnings’ growth represents a deceleration from the prior quarter’s level, but that’s a normal occurrence particularly from Q1 to Q2. In all, total earnings for the quarter are on track to reach a new all-time quarterly record, breaking the previous one set in Q4 2016.

Earnings Trends Matter – But Here’s What You Should Really Be Watching

In 1979, Len Zacks (yes, we’re related) published a study showing that stock prices respond less to changes in actual earnings than they do to changes in analyst estimates of earnings – a very important distinction. Len found that stocks most likely to outperform in the future are those whose earnings estimates are being raised today. Similarly, the stocks most likely to underperform are the ones whose earnings estimates are being lowered today.

These days, companies routinely lower their earnings estimates to set a lower hurdle for appeasing shareholders, so that’s to be expected. But, one very interesting feature of Q2 earnings season is the fact that companies/CEOs were not making deep ‘estimate cuts’ in the run-up to the start of earnings season. Downward revisions were at some of their lowest levels of the last two years. That fact is interesting on its own, but the story becomes more compelling given that companies are easily beating Q2 estimates:

As you can also see from the chart above, it is not just earnings that are widely surprising to the upside, but also revenue. Both earnings and revenue beats have been better in Q2 than they have over the last three years on average – a statistic that is underappreciated but very important in my view.

The bottom line is that the preponderance of positive surprises this earnings season, particularly on the revenues front, is reflecting a genuine improvement in underlying economic fundamentals. But, it also speaks to how corporations are effectively managing their businesses in the current environment and executing their company’s strategic operating plans. Folks may have differing views within the social and political spheres, but in the economic world it is difficult to argue against business being good.

Bottom Line for Investors

Here’s something you may have never heard before, but that is central to how we make investment decisions here at Zacks Investment Management: we believe that earnings estimate revisions are one of the most powerful forces impacting stock prices. While many others focus on corporate earnings on the whole, we take it a step further and analyze how those earnings stack up against estimates and how those estimates evolve quarter to quarter. Some readers may not know this, but Zacks Investment Research pioneered the earnings surprise and estimate revision factors, and as such that gives us (Zacks Investment Management) truly independent research capabilities. We think we have found a better way to invest, and we believe our unique approach distinguishes us from other wealth management and investment firms. If you would like to learn more about our investing approach, please feel free to contact one of our wealth management advisors at 1-888-600-2783.

Disclosure

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.