Without too much fanfare, the S&P 500 marched into a new bull market on June 8, having risen 20% from its October low.1

S&P 500 Since January 1, 2020

Source: Federal Reserve Bank of St. Louis2

The bear market was long, but not particularly steep. At 248 trading days, it was the longest bear market since 1948, but its drawdown of roughly -25% places it amongst the more modest bear markets historically. For context, the 2008 Global Financial Crisis bear was roughly twice as bad, registering a -52% total decline.

Even though I would argue this bull market is as ‘unloved’ as they get—with investors still very focused on the possibility of a recession in the second half—there are a few signs sentiment is turning. Stock-focused mutual funds and ETFs saw their largest weekly inflow in the last week of May, following several months of net outflows. Enthusiasm for bond funds has gone in the opposite direction over the same stretch.

Individual investors are also changing their tune from earlier in the year. According to the American Association of Individual Investors, the share of respondents who said they were bullish on stocks rose in June from 29.1% to 44.5%, perhaps as the ‘fear of missing out’ on the tech rally pulled some investors off the sidelines. As I mentioned in last week’s column, there is a record-high $5.7 trillion of cash parked in money market funds, which we could easily see rotate into the stock market if investors get the sense that the rally has legs.

Skeptics have pointed to the lack of breadth in the market rally, which argues the bull market has a weak foundation. A surge of interest in artificial intelligence propelled a handful of tech stocks higher, with just a few mega-cap names accounting for a majority of the market’s year-to-date returns.

These are valid concerns. But recent weeks have seen a shift in this narrative, too. As of the middle of last week, there were 20 stocks responsible for the S&P 500’s positive return in 2023, up from 8 stocks at the end of May. And small-cap stocks have also been participating in the rally, with the Russell 2000 rising over 7% in the first two weeks of June – its strongest start to a calendar month in over two years. A sustained rally in small-cap stocks could imply a ‘risk-on’ mindset among investors, perhaps in anticipation of a cyclical upturn in economic activity later this year or in early 2024.

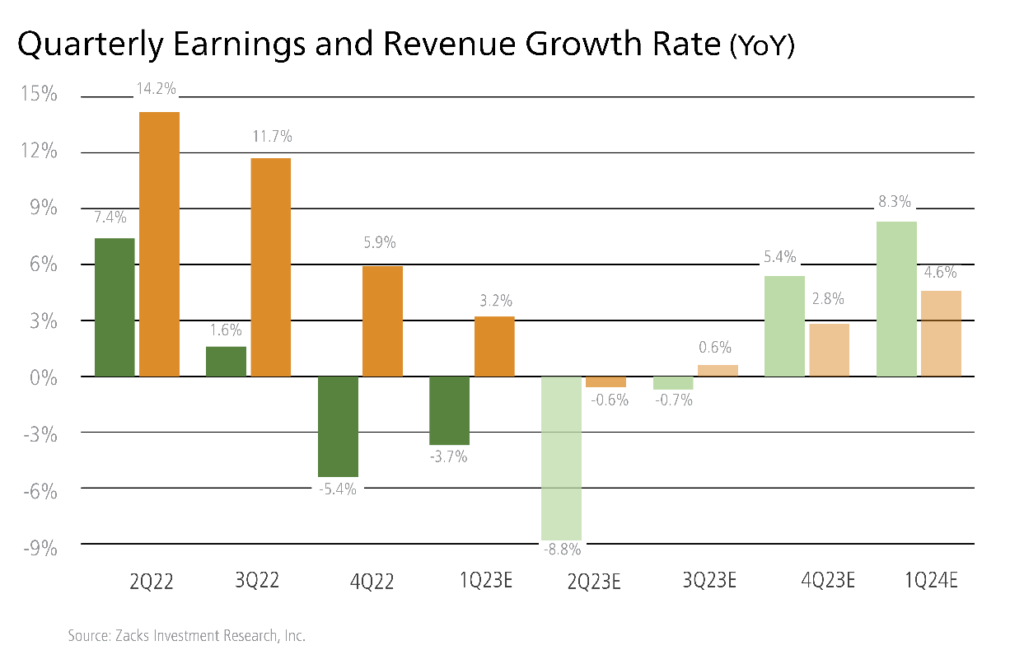

Even still, there is a growing sense among investors that the market is defying gravity, given the recession narrative that continues to linger in the backdrop. What’s missing here is the idea that the stock market already priced in the recession possibility with 2022’s bear market, and it is now looking ahead to the earnings recovery we expect to see in the fourth quarter of 2023 and early next year (see chart below). With employers hiring at a robust clip, consumers still outspending, and stability in the housing and banking sectors, the odds of averting recession are also rising, a point many investors miss.

Zacks.com3

History also tells us that once a bull market takes hold, it tends to keep going. Going back to the 1950s, once the S&P 500 entered bull market territory, it has gone up 92% of the time in the following year with an average return of +19%.

Bottom Line for Investors

Even though the market has nearly retraced the losses from 2022’s bear, that does not necessarily mean all investors are very close to recapturing portfolio highs. The rule of geometric compounding reminds us that losing -30% one year and gaining 30% the next does not mean breaking even. The key is to use a diversified portfolio to try and limit losses during major drawdowns while leaning on active management to generate alpha when the market is in recovery mode – which is where I think we are now.

Disclosure

2 Fred Economic Data. June 16, 2023. https://fred.stlouisfed.org/series/SP500

3 Zacks.com. June 7, 2023. https://www.zacks.com/commentary/2105443/looking-ahead-to-the-q2-earnings-season

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.