Bryan W. from Columbia, S.C. asks: Hello Mitch, I’ve noticed that oil prices have been locked in a downtrend for some time now. That’s great for gas prices and energy costs in general, but is it also a sign that global demand is falling off a cliff? Which, I would take to mean the economy is headed in the same direction?

Mitch’s Response:

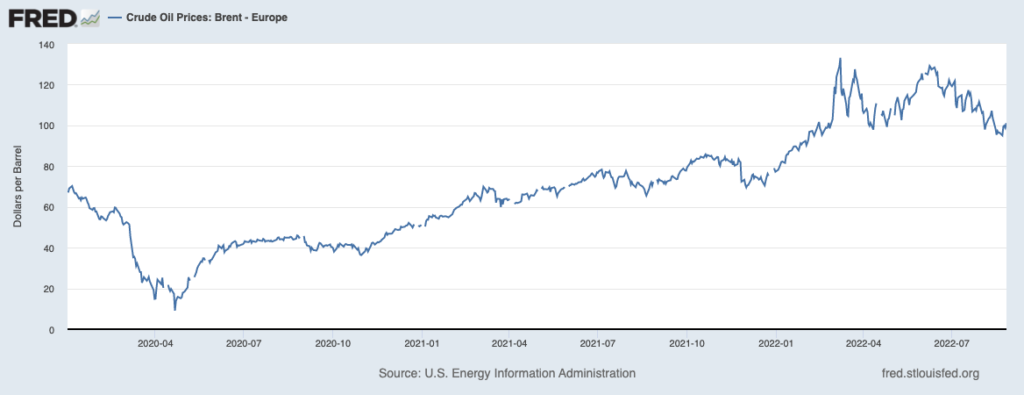

Thanks for sending your question! You are on target when it comes to oil prices – as I write, a barrel of crude is off about -25% from March highs, and as the chart below shows, it’s been in a pretty steady slide.1

Price of a Barrel of Brent Crude

How to Use Market Volatility to Your Advantage

Sudden ups and downs of the market can be very challenging to manage. What happens to your investments when the market drastically declines?

Turbulence in the market is normal, but it’s important that investors are aware of the positive aspects of volatility. If you have $500,000 or more to invest, get our free guide, “Using Market Volatility to Your Advantage,” and learn our insights, based on decades of experience, about how a volatile market may be able to help investors refine their strategies and potentially generate solid returns over time.

You’ll get our ideas on:

- How market volatility can “shake up” complacent investors

- Potential bargains that may be uncovered through turbulence

- Why volatility may help prevent overheating and market “bubbles”

- What history shows us about opportunities for steady investors in turbulent markets

- Plus, more ways you may be able to benefit from a volatile market

Download Our Guide, “Using Market Volatility to Your Advantage”3

Gasoline prices have also followed suit, which as you mentioned is a relief not only to consumers but also to inflationary pressures. Gas, food, and housing/rent prices have all been fairly significant contributors to rising prices, so the softening there has been welcomed.

I agree with you to a certain degree that falling commodity demand – tied to reduced global growth expectations – is playing a role here. We know the U.S. and Europe experienced weak growth in the first half, and China’s ongoing Covid-19 restrictions and trouble in the property market have dented growth prospects there as well. Expectations for the full year 2023 GDP growth in China keep scaling down, all of which implies less demand for oil and other commodities needed to fuel growth.

What I would add though is that supply is also playing a key role in shifting oil prices. The initial shock from the war threw Russia into question as a top producer, and sanctions from the U.S. and Europe also threw the supply-demand equation out of balance. But since then, Russian oil has started to flow elsewhere, mainly in Southeast Asia and China, and higher prices have also spurred some additional production in the U.S. and elsewhere. Oil markets are global and market-based, and I think the supply shock from the war has started to balance itself out again.

To make the most out of turbulent times in the market, I recommend that investors use market volatility to their advantage. I am offering all readers our guide, “Using Market Volatility to Your Advantage.”4 This guide will help you learn our insights, based on decades of experience, about how a volatile market may be able to help investors refine their strategies and potentially generate solid returns over time.

You’ll get our ideas on:

- How market volatility can “shake up” complacent investors

- Potential bargains that may be uncovered through turbulence

- Why volatility may help prevent overheating and market “bubbles”

- What history shows us about opportunities for steady investors in turbulent markets

- Plus, more ways you may be able to benefit from a volatile market

If you have $500,000 or more to invest, download this free guide today by clicking on the link below.

Disclosure

2 Fred Economic Data. August 31, 2022. https://fred.stlouisfed.org/series/DCOILBRENTEU#

3 ZIM may amend or rescind the free guide offer, Using Market Volatility to Your Advantage, for any reason and at ZIM’s discretion.

4 ZIM may amend or rescind the free guide offer, Using Market Volatility to Your Advantage, for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.