With the exception of mostly Energy stocks, the broad U.S. stock market has been locked in correction mode for the last few weeks. Technology companies and growth stocks have been among the hardest hit, but even mega-cap companies with steady earnings have felt the pressure. As I’ll explain below, every new day of volatility makes me more bullish for full-year 2022.

To be fair, financial headlines don’t make dealing with the volatility easy. The focus is constantly on the challenges and the economic negatives, like high inflation, rising interest rates, spiraling crude oil prices, and concerns about economic shockwaves that could ripple from the war in Ukraine. But no one ever talks about earnings, which is why I think investors should embrace the current market volatility, not fear it.

______________________________________________________________________________

Focus On Key Data Points Instead of Negative Headlines

In times like this when market volatility is becoming a huge concern for investors, it is important not to lose sight of the long-term view. Don’t let the media and sudden changes in the market cause you to make knee-jerk responses based on emotion.

I recommend that investors remain calm and not let emotions take control of their investments. To help you do this, I am offering all readers our just-released March Stock Market Outlook report. This report contains some of our key forecasts & factors to consider such as:

- Zacks Rank S&P 500 Sector Picks

- Zacks view on equity markets

- What produces optimism?

- Zacks forecasts

- Zacks ranks industry tables

- Sell-side and buy-side consensus

And much more…If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

Free Download – March 2022 Stock Market Outlook Report!2

______________________________________________________________________________

Said another way, when economic positives are under-appreciated, and negative news stories accompany sharp, sudden, scary selling pressure, that almost always means it’s a great time to be bullish.

Consider this data for 2022 through February 28:

- S&P 500 Price Return: -8.2%

- Decline in S&P 500 valuation multiple: -10.7%

- Change in S&P 500 Earnings Growth: +2.4%

S&P 500 earnings have been going up while the index has been falling, which also means the P/E ratio on the U.S. stock market has moved lower. The investor read-out here is that stocks have gotten cheaper relative to corporate earnings, which investors should see as an opportunity, not an omen. 1

This optimistic framing of the current market is especially true if an investor expects the U.S. economy and U.S. corporations to grow in 2022, which is our base case here at Zacks Investment Management. I’m looking for the U.S. economy to grow nominal GDP above trend this year, which I could see hitting ~7%. Since corporate earnings and revenue track GDP growth, I’d also expect corporations to have a good year.

At Zacks, we are currently calling for +7.3% earnings growth for the full year of 2022, on +6.2% revenue growth. Of course, this is a far cry from the 49.9% earnings growth posted in 2021, but that year was also gangbusters because of easy comparisons with the global economic shutdown year in 2020. By most accounts, 2021 was a strong growth year even with pandemic pressures, so an additional 7+% earnings growth in 2022 is meaningful.

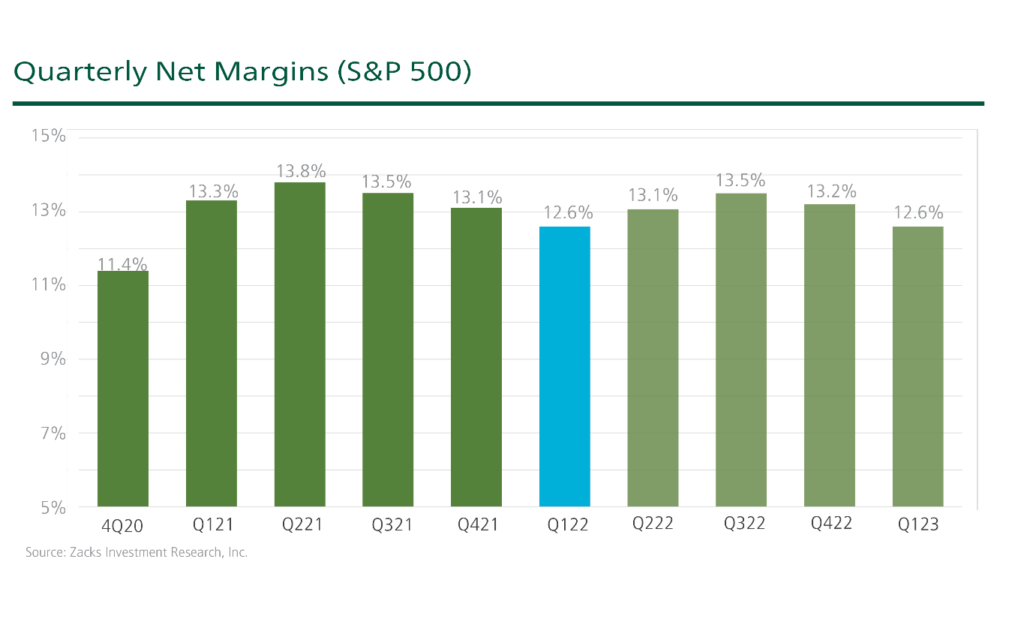

Profit margins are also not mentioned very often in the financial news, but from a fundamental analysis viewpoint, it is hard to be bearish when margins are this good. S&P 500 companies are expected to generate 12+% profit margins throughout 2022, continuing a strong trend established in 2021 (see chart below). Before the sizable December 2017 corporate tax cut, profit margins were consistently below 10%.3

I do not mean to downplay the current economic headwinds and geopolitical challenges the world faces. But in fairness, those seem to be the only things the media focuses on, which means positives are being ignored during a period of heightened volatility – a confirmation of a correction (not a bear), and a recipe for more bull market, in my view.

Bottom Line for Investors

The pushback against the bull case is that stocks are already expensive, and the Fed is poised to tighten financial conditions throughout the year. But it’s also true that the current market pullback has led to multiple compression, such that the S&P 500 is trading below 19x forward earnings while the 10-year U.S. Treasury bond yield remains below 2.5%. If aggregate S&P 500 earnings reach $250 by the end of 2022, I think there’s a good case in arguing that the stock market is currently quite cheap.

As for the Fed, I think it is important to remember that 2022’s rate increases are coming off an era of very easy monetary policy, such that six rate increases would still mean seeing the fed funds rate at 2% – very low by historical standards.4 I think the right framing for 2022 is that the Fed is taking steps to remove excess accommodation and tamp down inflation, not paralyze the economy.

The bottom line in the current environment is that stocks have gotten cheaper, fundamentals have largely remained the same, and investors are arguably more worried than ever. This to me marks a compelling setup for embracing volatility, not fearing it.

To help you embrace market volatility, I recommend that investors do the appropriate research to better invest towards their long-term goals. I am giving exclusive access to our Just-Released March 2022 Stock Market Outlook Report.

You’ll discover Zacks’ view on:

- Zacks Rank S&P 500 Sector Picks

- Zacks view on equity markets

- What produces optimism?

- Zacks forecasts

- Zacks ranks industry tables

- Sell-side and buy-side consensus

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free guide.

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

3 Zacks. March 11, 2022. https://www.zacks.com/commentary/1881058/what-to-expect-from-the-q1-2022-earnings-season

4 Black Rock. February 7, 2022. https://www.blackrock.com/us/individual/insights/equitymarkets

5 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.