In today’s Steady Investor, we are taking a deeper dive into key factors that we believe are impacting the future state of this market, such as:

- European economy picks up

- Small businesses are hiring

- Leading indicator in the labor market

European Economy Shows Sign of Stabilizing – The worst-case scenarios for Europe’s economy may have been avoided. For months, there were fears that energy shortages, high inflation, and rising interest rates would send Europe into a recession. But thanks to a mild winter, energy-conservation efforts, a shift in sourcing for natural gas, and hundreds of billions in new fiscal spending, Europe appears able to avoid a recession – at least for now. S&P Global’s composite purchasing managers index – which gives a good read on activity in services and manufacturing – showed Europe moving from contraction territory (49.3) to expansion (50.2) in January. Germany, Europe’s largest and most vital economy, showed strong signs of stabilizing which prompted the German Economy Ministry to forecast 0.2% growth in 2023. Last fall, the ministry called for a -0.4% contraction. December composite output data for the U.S. also improved, but the index remains in contraction territory (46.6). Europe’s economic stabilization coupled with China’s reopening could prevent the global economy from entering a recession in 2023, and the fact that the U.S. is nearing the end of its interest rate cycle may also provide support to a ‘better-than-expected’ outcome for growth this year.1

Handling Volatility – What You Should Do!

Volatility often results in emotional decision-making—like when investors believe that selling out of stocks is the best route to avoid further losses. The real challenge is not finding a way to eliminate volatility—it is developing a mental approach to dealing with it. Our guide, “Helping You Manage Market Volatility,” will provide you with insights and tips to do just that. Get answers to questions like:

- Market downturns can and will occur, but what should you do?

- How can diversification help you manage volatility without compromising your returns?

- When volatility is too much for you to handle, how can a money manager help?

- Can volatility be an opportunity?

If you have $500,000 or more to invest and want to get answers to the questions above, click on the link below to download this guide today!

Download Zacks Volatility Guide, “Helping You Manage Market Volatility.”2

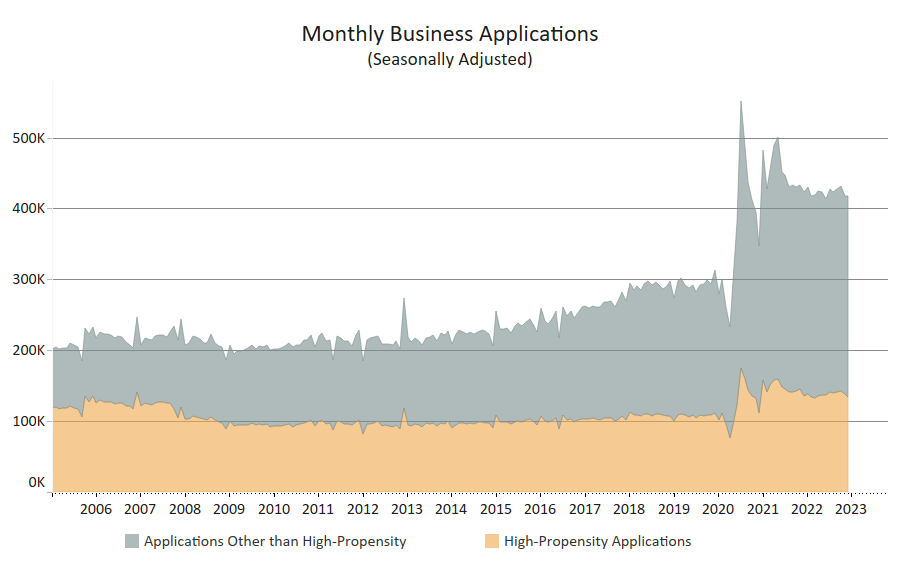

Still Innovating – Recent headlines have shined a spotlight on high-profile layoffs, mainly at the biggest technology companies like Google, Meta, Amazon, and Microsoft. But a major engine in the U.S. economy is one that often gets less coverage: entrepreneurs and small businesses. By these measures, the economy continues to look stronger than most appreciate. In 2022, Americans filed more than 5 million applications to start new businesses, the second-highest total on record.3

This boom in business formation suggests that innovators and entrepreneurs are not being fazed by the possibility of a looming recession. In fact, this has been true basically since the start of the pandemic. According to Labor Department data, small businesses (with fewer than 250 employees) have hired a net of 3.67 million people since February 2020, compared to large businesses shedding some 800,000 jobs over the same period. Today, 80% of available job openings are for positions at small businesses, underscoring this vital, yet underappreciated, feature of the U.S. economy.

A Leading Indicator in the Labor Market Points to Possible Weakness Ahead – Small businesses and new business formation look strong. But another overlooked aspect of the jobs market is starting to show weakness: the firing of temporary workers. In the final five months of 2022, employers parted ways with 110,800 temporary workers, including 35,000 in December alone. Many of the December workers were likely hires brought on to help with the holiday shopping season, which we now know was strongest in October and November but fizzled off in December. Trends in the temp worker market are worth watching because in the past they have been reliable leading indicators for economic weakness. In 2001 and early 2007, pullbacks in temporary employment preceded pullbacks in the broader labor market, which were both triggered by recessions. In a sense, this trend in labor markets may ultimately be good news, to the extent the Federal Reserve views it as a sign that tighter financial conditions are easing job and wage pressures.5

Navigating Through Market Volatility – One challenge investors will face this year is market volatility. While there may not be ways to eliminate it, there are ways to navigate it and even prosper through it.

In our guide, “Helping You Manage Market Volatility,”6 we provide you with insights and tips to do just that. Get answers to questions like:

- Market downturns can and will occur, but what should you do?

- How can diversification help you manage volatility without compromising your returns?

- When volatility is too much for you to handle, how can a money manager help?

- Can volatility actually be an opportunity?

If you have $500,000 or more to invest and want to get answers to the questions above, click on the link below to download this guide today!

Disclosure

2 ZIM may amend or rescind the free guide offer, Using Market Volatility to Your Advantage, for any reason and at ZIM’s discretion.

3 Wall Street Journal. January 25, 2023. https://www.wsj.com/articles/surge-in-hiring-by-small-business-complicates-feds-effort-to-cool-economy-11674627479?mod=economy_lead_story

4 Census. 2023. https://www.census.gov/econ/bfs/img/business_applications.png

5 Wall Street Journal. January 24, 2023. https://www.wsj.com/articles/companies-cut-temp-workers-in-warning-sign-for-labor-market-11674524006?mod=economy_more_pos3

6 ZIM may amend or rescind the free guide offer, Using Market Volatility to Your Advantage, for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.