Colleen B. from Little Rock, AR asks: Seasons Greetings Mitch, I’m curious what happens in the markets now that inflation looks like it has peaked already. If inflation isn’t getting any worse, shouldn’t the stock market start to do better in the new year? Thank you and Happy New Year!

Mitch’s Response:

Thanks for writing, Colleen, and Happy New Year to you as well! I see better days ahead.1

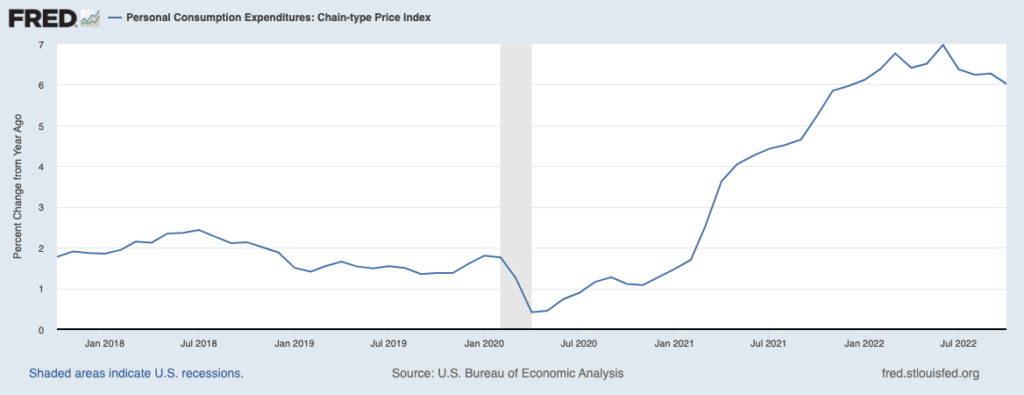

Your question is about how a peak in inflation may impact markets, potentially in a positive direction. For readers who have not been following the inflation story very closely, Colleen is referring to various measures of inflation having peaked around June 2022. The chart below shows the Federal Reserve’s preferred inflation gauge, the personal consumption expenditures (PCE) index. As readers can see, it appears by this measure that inflation peaked in June 2022.

PCE Index (Year-Over-Year Change in Inflation)

How to Protect Your Retirement Portfolio from Rising Inflation!

Are you concerned about the effects of inflation on your investments and retirement portfolio?

Instead of making rash moves, take a look at steps that could help reduce the sting of inflation. To help, we’re offering our exclusive guide, 4 Ways to Protect Your Retirement from Rising Inflation3. You will get insight on:

- Asset allocations that outperform inflation

- Spending categories where prices are rising the most

- Getting the most from Social Security benefits

- Plus, many more ideas to protect yourself and your assets against inflation

If you have $500,000 or more to invest, get our free guide today!

Even though more data points are needed to confirm whether inflation has indeed already peaked, I think there are clear components of inflation data that are firmly in a downtrend. Goods inflation that stemmed from supply constraints like closed factories, higher shipping costs, and snarled supply chains has largely faded; shelter and owners’ equivalent rent components operate on a lag, but recent data like falling housing prices and lower prices on new rental leases offer hope; finally, the impact of higher prices for used cars, semiconductors, and airfares appears to have run its course. Energy prices have also retreated from peaks.

To be fair, however, upside surprises to inflation were commonplace in 2022. Many economists and consensus estimates were wrong, even my own. With every inflation miss, the Federal Reserve responded by digging deeper into its hawkish stance, pushing the terminal fed funds rate higher in the process. Expectations for peak fed funds now stand at 5% in May 2023, but the market may still be too optimistic about when rates will start to come down.

The primary reason is the unpredictability of services inflation, which stems from companies taking advantage of pricing power to raise prices. But it also comes from issues in the jobs market, where labor scarcity continues to drive up wages. This will be the key factor to watch in 2023.

To your question about the impact on markets, we know that since 1960, the consumer price index (which measures inflation) has gone above 6% on four occasions, in 1970, 1974, 1979, and 1990. In every instance where CPI peaked and started falling, stocks staged relatively powerful rebounds. It follows that peaking inflation in this cycle would arguably be a tailwind for stocks.

The issue clouding this outlook, however, is uncertainty over how high the Fed will go and how long they will keep rates at elevated levels. The market may be too optimistic about the Fed’s willingness to cut rates in 2023, as there are plenty of historical cases of loosening too soon before the inflation battle is won. But it’s also true that the Fed has succumbed in the past to job losses and recession as a trigger for easing monetary policy. If inflation gets down to acceptable levels sometime in 2023, providing the Fed more flexibility, then markets will have a much clearer path for a sustained rally.

If you’re worried about the impact of inflation on your portfolio, remember that there are steps you can take to prevent it from affecting your long-term investments.

We recommend taking a look at steps that could help reduce the sting of inflation. To help, we’re offering our exclusive guide, 4 Ways to Protect Your Retirement from Rising Inflation4. You will get insight on:

- Asset allocations that outperform inflation

- Spending categories where prices are rising the most

- Getting the most from Social Security benefits

- Plus, many more ideas to protect yourself and your assets against inflation

If you have $500,000 or more to invest, get our free guide today!

Disclosure

2 Fred Economic Data. December 23, 2022. https://fred.stlouisfed.org/series/PCEPI#

3 Zacks Investment Management reserves the right to amend the terms or rescind the free 4 Ways to Protect Your Retirement from Rising Inflation offer at any time and for any reason at its discretion.

4 Zacks Investment Management reserves the right to amend the terms or rescind the free 4 Ways to Protect Your Retirement from Rising Inflation offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.