In this week’s Steady Investor, we look at some of the current events that are shifting the market, such as:

- Inflation status

- Regional banking crisis update

- Still no deal on the debt ceiling

Inflation Ticks Lower in April, But Not Convincingly – The Bureau of Labor Statistics reported this week that the consumer price index’s (CPI) measure of inflation rose by 4.9% year-over-year in April. This inflation print marks a slight decline from March’s 5% reading but remains a solid improvement from the 9.1% peak reached in June 2022. Core prices, which strip out food and energy, rose 5.5% y-o-y in April, a slight improvement from March’s 5.6% increase. Higher core prices are largely a byproduct of pressure in services prices—and specifically, the shelter component, which makes up one-third of the index. The upshot here is that shelter prices measure what renters and homeowners are paying for new and existing leases, which means meaningful declines in rents will not show up immediately in the CPI number. Given that median rents in the U.S. have been falling, the shelter component should contribute significantly less to the CPI number by this summer and fall. Excluding shelter, food, and energy prices – the so-termed “supercore” inflation reading – prices were up 3.7% year-over-year in April. This latest inflation report supports the view that the Fed could pause rate increases at their next meeting. Even though inflation remains high, Fed officials have shifted to looking for signs that economic growth and inflation are stronger and higher than expected, neither condition of which is overtly apparent today. The labor market remains tight, but downward trending inflation and negative corporate earnings growth suggest the economy is not running too hot. According to the CME group, the market sees a 14% chance the Fed would hike another 25 basis points at the next meeting.1

Retiring Soon? Here’s What You Need to Know!

As uncertainty rises surrounding the future of the market, we understand how difficult it can be to make future financial decisions – especially for those who are trying to build their retirement portfolio.

We are offering readers our free guide that provides a step-by-step blueprint to help you build a sound retirement portfolio. This guide offers you a checklist of the most important financial, tax, and investment considerations for retirees, with detailed explanations to help you prepare for this new stage in your life.

If you have $500,000 or more to invest, get our free guide today!

Download Zacks Guide, Looking to Retire Soon2

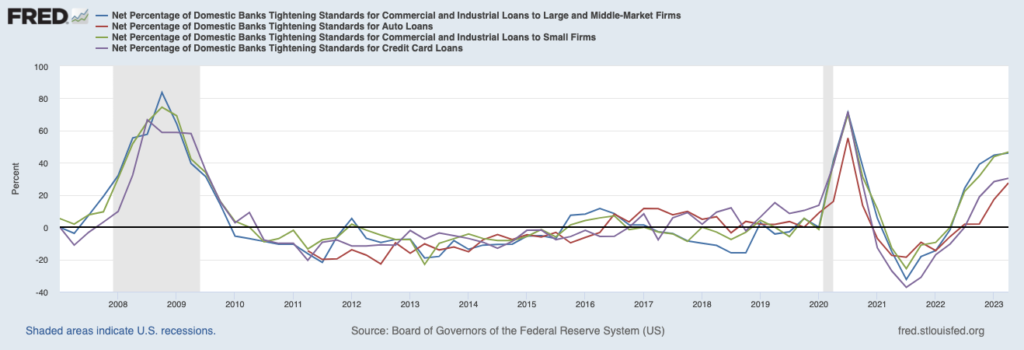

Keeping a Watchful Eye on Lending Standards – The regional bank ‘crisis’ has tapered off since the fall of First Republic Bank, but the legacy of bank stress in 2023 may be one of tighter lending and credit standards. These factors will be key to watch throughout the year. If banks decide that a dollar in reserves is better than a dollar lent to consumers or businesses, it could choke off a key source of capital and credit that would otherwise fuel growth. The Federal Reserve publishes weekly loan activity for small and large banks, which will be important to watch. But the Federal Reserve Bank of St. Louis also conducts a Senior Loan Officer Opinion Survey, which polls lending officers at major banks on credit and loan standards. So far, the polls suggest that many major banks are indeed tightening standards, as seen in the chart below. The chart looks at the net percentage of banks tightening standards for loans to small-, mid-, and large-size businesses, auto loans, and credit cards. Standards are tightening across the board, which is likely to impact economic growth in the second half of the year.3

Source: Federal Reserve Bank of St. Louis4

Still No Deal on the Debt Ceiling – Congressional leaders met with President Biden this week to discuss what it would take to raise the debt ceiling. So far, no progress on a deal has been reported. The two sides have agreed to meet again, however, which may factor as a positive sign. Debt ceiling standoffs have become more common in the last decade or so, the drama of which sometimes pushes up to the “X date” when the U.S. would need to start delaying payments on some obligations. It is unclear which payments would be missed first, but defaulting on debt – i.e., not making interest payments on bonds – would likely be last. Government wages, Social Security, Medicare, and other entitlement programs would likely see delays or “IOUs” happen first. For its part, the market does not seem to be too fazed by the posturing on the debt ceiling just yet. Stocks rose in April, and Treasuries were essentially flat – with both exhibiting relatively low volatility.5

Planning to Retire Soon? – Retirement marks the end of one life stage, and the beginning of another. To guide you through this new phase, we recommend a thorough review of your financial situation.

Our guide, Looking to Retire Soon5 walks through four essential financial and investment topics for retirees, with detailed helpful information about:

- The current and expected future costs of healthcare in retirement

- Strategies for retirement investment income in today’s current low-rate environment

- The key tax rules that every retiree must know

- The most important way to protect your retirement assets from market volatility

If you have $500,000 or more to invest and want to understand your retirement options, get our guide today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free How the Looking to Retire Soon? Here are 4 Things to Consider First offer at any time and for any reason at its discretion.

3 Federal Reserve. 2023. https://www.federalreserve.gov/data/sloos/sloos-202304.htm?mod=djemRTE_h

4 Fred Economic Data. May 8, 2023. https://fred.stlouisfed.org/series/DRTSCILM#

5 Wall Street Journal. May 2, 2023. https://www.wsj.com/articles/treasury-secretary-janet-yellen-says-u-s-could-default-as-soon-as-june-1-without-a-debt-ceiling-increase-6714ed7c?mod=article_inline

6 Zacks Investment Management reserves the right to amend the terms or rescind the free How the Looking to Retire Soon? Here are 4 Things to Consider First offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.