With everyone’s attention locked on the U.S. midterm elections, inflation data, and projections for future Fed policy, it is easy to overlook the indicator that arguably matters the most – earnings.

Going into Q3 earnings season, many feared U.S. corporations were heading towards an “earnings cliff,” fueled by a sputtering economy and persistent price pressures. But that’s not what we got.1

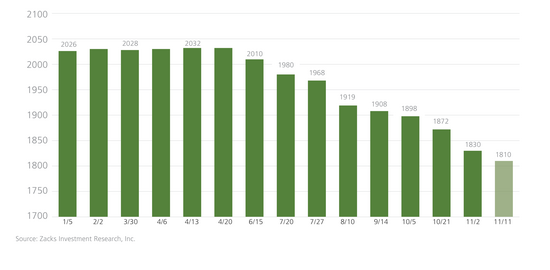

Instead, the overall takeaway from the Q3 earnings season was a relief, specifically that earnings were not as bad as expected. To be sure, earnings overall were not great in Q3 – in aggregate, S&P 500 companies exceeded earnings estimates by a meager 1.8%, which is significantly lower than the 10-year average of 6.5%. We also saw earnings growth of 1.6% on 11.3% higher revenues, which as you can see on the chart below continues a year-long downward trend for results.

_________________________________________________________________________

Get the First Look at Our Just-Released Stock Market Outlook Report!

It can be easy to get caught up in headlines that focus on attention-grabbing topics, like the ones listed above.

But there are many other important factors impacting the markets, like earnings, that you should be keeping an eye on. To help you do this, I am offering all readers a first look into our just-released December 2022 Stock Market Outlook report.

This report will provide you with our forecasts along with additional factors to consider:

- What fundamentals are U.S. stock markets pricing in?

- Setting U.S. return expectations for 2023

- Zacks forecasts at a glance

- What’s ‘fair value’ on the S&P500?

- And more…

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released December 2022 Stock Market Outlook2

_________________________________________________________________________

But ‘not great’ earnings are a far cry from the outright earnings cliff many were expecting. There was a narrative in the market that corporations were not lowering earnings expectations enough given the macroeconomic environment, which would in turn lead to a dramatic downshift in estimates in Q3 earnings calls – part of the so-called ‘cliff.’ Our earnings analysts at Zacks questioned this narrative though, as we had been covering the persistent cuts to forward earnings estimates over the last few months.

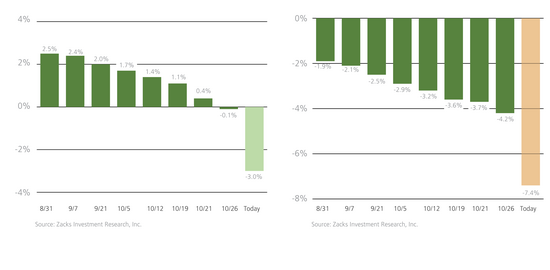

At Zacks, we of course take earnings estimate revisions very seriously as they form the core of our stock-rating system. It follows that our analysis was showing that forward earnings estimate outside of the Energy sector peaked in April of this year, and have been steadily declining since then (see chart below).

Indeed, for the last seven months earnings estimates for 2023 have fallen by -7.4% for the S&P 500 index (-10.4% on an ex-Energy basis). Notably, the Technology sector has slashed forward estimates by -17.4% since mid-April and retailers have followed suit with an -18.2% reduction. The same goes for earnings estimates even just looking out to Q4, which have been progressively ticking downward as the charts below demonstrate:

In my view, corporations have been doing a reasonably good job telegraphing this expected soft patch and have been setting expectations appropriately for the markets. Stocks’ reactions to earnings beats in Q3 were largely positive for this very reason, I believe.

Another key takeaway from the Q3 2022 earnings season is that margins have not compressed nearly to the degree many expected. Revenues were up nicely for the quarter as companies were able to maintain pricing power in the face of rising prices, which helped preserve margins and even grow them in some cases. To date, net margins in Q3 earnings were down a modest -1.3% with 10 of the 16 Zacks sectors suffering margin contraction. But on the flip side, four sectors enjoyed higher margins relative to the year-earlier period, led by the Energy sector. This outcome is more balanced I think than many were expecting.

Bottom Line for Investors

The overall earnings picture in Q3 proved to be more resilient than many analysts and forecasters anticipated, which is of greatest relevance to the stock market. When actual revenue and earnings growth exceeds expectations – even by just a little as seen in Q3 – it is this performance relative to expectations that matters more than absolute earnings. In those terms, Q3 earnings can be framed as good, though not great.

Looking ahead to Q4 2022 and beyond, we continue to observe companies lowering earnings estimates as we have noted since April of this year. This should be viewed as a positive, not a negative. Lowering the bar of forward earnings estimates makes exceeding expectations easier to achieve, which is generally a boon for stocks.

I recommend preparing your investments by looking at key forecasts and data to guide your investing decisions. Our Just-Released Stock Market Outlook Report can help you do just that.

In this report, you will learn:

- What fundamentals are U.S. stock markets pricing in?

- Setting U.S. return expectations for 2023

- Zacks forecasts at a glance

- What’s ‘fair value’ on the S&P500?

- And more…

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free-Stock Market Outlook Report offer at any time and for any reason at its discretion.

3 Zacks. November 9, 2022. https://www.zacks.com/commentary/2016422/making-sense-of-the-earnings-picture-and-estimate-revisions

4 Zacks Investment Management reserves the right to amend the terms or rescind the free-Stock Market Outlook Report offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The ICE Exchange-Listed Fixed & Adjustable Rate Preferred Securities Index is a modified market capitalization weighted index composed of preferred stock and securities that are functionally equivalent to preferred stock including, but not limited to, depositary preferred securities, perpetual subordinated debt and certain securities issued by banks and other financial institutions that are eligible for capital treatment with respect to such instruments akin to that received for issuance of straight preferred stock. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.