Recent market volatility has some investors on edge. From August 18 – August 25, 2015, the S&P 500 declined over 10% and in noisy fashion, with big down days and media reports instilling fears of an impending global economic slowdown (rooted in China). Those six trading days alerted many investors to the possibility that this bull market may be losing its luster, if not coming to an abrupt halt.

For retirees, it’s not that equity volatility is a new phenomenon – it’s a normal feature of every market cycle, and history tells us it’s been a part of every bull market to date. What concerned investors was the dramatic nature of this particular volatility, specifically its suddenness and steepness. Was this another 2008 in the making?

We did not think it was the start of another bear market back in August, and we still don’t today. Market fundamentals, in our view, point to more upside in the next six to twelve months. But, for investors who did not share our conviction, it was surely tempting to trim equity exposure or sell out of stocks completely.

To address this temptation, and help retirees cope with future volatility, we encourage you to review these six bullets each time market gyrations have you second guessing your investment strategy.

- Downside Volatility is Normal – since 1980, the S&P 500 has experienced an average intra-year decline of -14.2%, yet it finished positive in 27 of those 35 years. More often than not, when the market’s down that doesn’t mean it’s ‘out.’

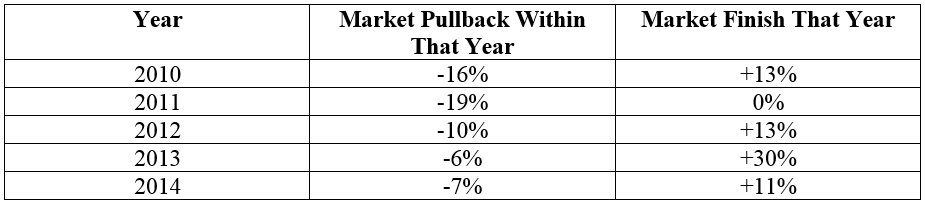

- We’ve Already Seen Similar Downside Volatility in This Bull Market – several times in fact. Taking a look at the data below, you can see that bouts of volatility have appeared almost every year, yet the bull market pressed on.

- Volatility Works Both Ways – when investors use the word “volatility,” they’re often referring only to market sell-offs. But there’s also such a thing as upside volatility! 2014 offers a good example: from September 19 – October 17, the market fell about 7%, but by Halloween it had reversed course and jumped 7%. The same percentage move but in half the time. Investors that sell out of stocks for fear of downside volatility risk getting whipsawed.

- There are Methods You Can Use to Mitigate Volatility – two in particular:

- Diversification: many investors limit their view of diversification to being a matter of stocks vs. bonds, but it can be much more than that. Diversifying across asset classes (stocks, bonds, commodities, real estate), sectors, styles (value, growth), size (small, mid, large-cap), and regions are more ways an investor can reduce overall risk while still creating opportunities for equity-like long-term returns.

- Focusing on Investment Time Horizon: since 1950, in one year periods, the S&P 500 has returned anywhere from +51% (in 1954) to -37% (in 2008). But if you look at rolling 20-year periods, the S&P 500 has not delivered negative returns once in the post-war era. In other words, the longer you invest the better chance of achieving long-term positive returns.

- It Makes Sense to Reduce Withdrawals During Volatile Markets – if your financial situation allows for it, reducing or suspending cash flows from your portfolio during market corrections could help significantly. Withdrawing cash from a portfolio experiencing downside means exacerbating the downside impact, meaning you would need additional upside to recover.

- Don’t Forget Fundamentals – downside volatility often causes investors to focus on the headlines instead of trend-lines. In this case, steep declines might make many forget that global GDP is still expected to grow by over 2% on year, and that a bulk of U.S. corporations (excluding Energy) are still posting nice positive earnings; not to forget that interest rates globally are low and inflation is in check.

Bottom Line for Retirees and Those Approaching Retirement

No matter how long you’ve been an equity investor, experiencing downside volatility can be a gut-wrenching event – especially if you are at or near retirement and your nest egg is on the line. But, the next time the market shows downside pressure and the headlines are ablaze with worries about the economic future, we’d encourage you to maintain perspective by reviewing the six bullets above. More often than not, volatility is short-lived and the market climbs the wall of worry.

DISCLOSURE This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees or other expenses. An investor cannot invest directly in this Index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.