The Unloved U.S. Economic Expansion

The U.S. economy is charging ahead. Few are happy about it.

According to the “advance” estimate from the Bureau of Economic Analysis, U.S. GDP expanded at a blistering 4.9% annual rate in Q3, a significant jump from the pace set in the first half of the year. A strong labor market and rising wages continue to bolster consumer spending, which has remained resilient all year. Q3 output was also boosted by increases in private inventory investment, government spending, and exports.1

All told, the U.S. economy has recovered fully from the pandemic, and the current unemployment rate of 3.8% is just a tick higher than it was in January 2020, before the pandemic hit. Monthly payroll growth has averaged 258,000 per month over the past year, with average hourly earnings rising 4.1% year-over-year in October. Since inflation as measured by the headline PCE price index came in at 3.4% year-over-year in September, the takeaway is that Americans are seeing “real wage growth.” Indeed, real disposable income rose 3.0% during the first nine months of the year.

Americans are earning more, the economy is growing, and household net worth has surged. From the end of 2019 through the end of Q2 2023, household net worth rose $37.6 trillion, a 37% increase even when adjusted for inflation. That’s the fastest surge in new wealth ever recorded.

It’s clear, in my view, that by most fundamental measures, the U.S. economy is in solid shape. But many Americans don’t feel very good about it.

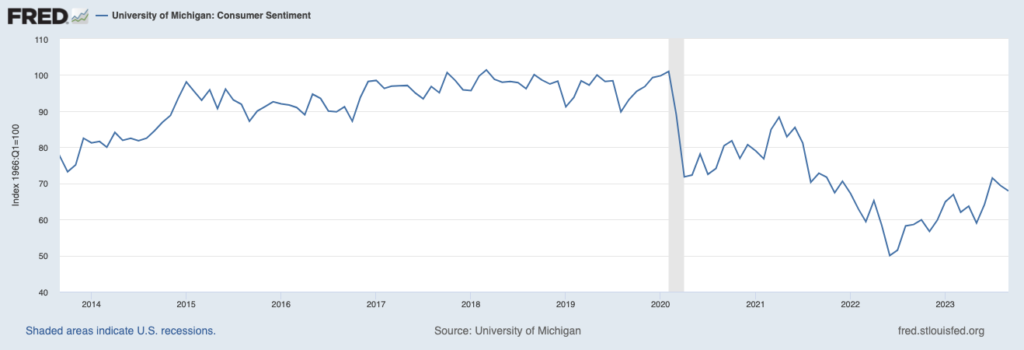

In October, measures of consumer confidence and consumer sentiment both fell, marking three consecutive months of souring on the economy. The Conference Board’s index of consumer confidence fell to 102.6 in October, returning to levels last seen in late 2022 (which, recall, was a year of rising interest rates and a bear market). Consumer confidence metrics fell across a broad range of categories, spanning consumer outlooks for income, business, and employment. The University of Michigan consumer sentiment index has also been bouncing around relatively low levels, as seen on the chart below:

The University of Michigan consumer sentiment index is essentially at levels consistent with recession, yet the economy is nowhere near contraction territory. One key explanation for the disconnect is inflation. In the University of Michigan’s survey, 40% of respondents said they felt worse off because of inflation.

We know inflation has been locked in a downtrend, but the issue in times of rising prices and rising wages is that consumers focus far more on prices. We also know that while the Federal Reserve is focused on inflation’s rate of change, consumers tend to focus more on how much things cost nominally. With inflation’s surge in 2022, the prices for everything from food to clothing to concert tickets reset to higher levels, which bothers consumers on an ongoing basis. While it’s true prices are no longer rising as quickly as they were last year, they are permanently higher – a reality that consumers don’t frame in the context of their wage gains.

From a purely economic and investment standpoint, however, there’s a lot to be optimistic about, in my view. The fundamentals I mentioned above are no doubt strong, with growth and inflation both improving in the third quarter. And the fact that sentiment remains at a relatively low point might also be framed as a positive. Stocks tend to do well historically when economic fundamentals are under-appreciated, or when investors are more worried or pessimistic than they should be. I see both of those conditions today.

Bottom Line for Investors

Focus on the fundamentals. The financial media and sentiment indexes will often paint the picture that there is a lot to be worried about, whether it’s geopolitical conflict, inflation, domestic political issues, and so on. These issues matter, of course, but arguably not as much as the media says they do. U.S. economic fundamentals matter more, as do corporate earnings trends. And for now, both are heading in the right direction.

Disclosure

2 Fred Economic Data. October 27, 2023. https://fred.stlouisfed.org/series/UMCSENT#

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The ICE Exchange-Listed Fixed & Adjustable Rate Preferred Securities Index is a modified market capitalization weighted index composed of preferred stock and securities that are functionally equivalent to preferred stock including, but not limited to, depositary preferred securities, perpetual subordinated debt and certain securities issued by banks and other financial institutions that are eligible for capital treatment with respect to such instruments akin to that received for issuance of straight preferred stock. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The MSCI ACWI ex U.S. Index captures large and mid-cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 24 Emerging Markets (EM) countries. The index covers approximately 85% of the global equity opportunity set outside the U.S. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Russell 2000 Index is a well-known, unmanaged index of the prices of 2000 small-cap company common stocks, selected by Russell. The Russell 2000 Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The S&P Mid Cap 400 provides investors with a benchmark for mid-sized companies. The index, which is distinct from the large-cap S&P 500, is designed to measure the performance of 400 mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment.

The S&P 500 Pure Value index is a style-concentrated index designed to track the performance of stocks that exhibit the strongest value characteristics by using a style-attractiveness-weighting scheme. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.