With all the recent headlines surrounding the current state of the market, we are taking a deeper dive into key factors that we believe investors should keep an eye on, such as:

- U.S. retail sales during the holiday

- American household savings

- Inflation and unemployment

The U.S. Consumer May be Stretched But is Still out Shopping – According to figures released by the Commerce Department last week, U.S. retail sales rose by a seasonally adjusted 1.3% in October, signaling a sharp increase in activity from September’s print. Shoppers spent more on everything from everyday staples like gas and food, but also more on bigger ticket discretionary items, like cars and furniture. Retailers are trying to keep the momentum going by discounting many items ahead of the Black Friday and Cyber Monday periods, as well stocked stores offer a departure from previous years. The retail sales report does not include spending on services like travel and hospitality, so investors wanting a fuller picture of the health of the U.S. consumer should wait for the report covering goods and services due at the end of November.1

_________________________________________________________________________

Explore the Do’s and Don’ts of Stock Market Volatility

Every investor understands the dread and anxiety of watching their investments take a turn when the market is red.

It is impossible to avoid volatility, but there are ways you can minimize the worst impacts of a volatile market. In our newest guide, ‘The Do’s and Don’ts of Stock Market Volatility’ we provide recommendations for investors, based on 30 years of expertise. We also explore:

- 3 best practices to successfully manage periods of market volatility

- 3 most common mistakes investors make, and why they are so damaging to your long-term investing goals

- Historical data that supports our conclusions and underscores the recommendations we propose

If you have $500,000 or more to invest, get our free guide today!

Download Your Copy Today: The Do’s and Don’ts of Stock Market Volatility2

____________________________________________________________________________

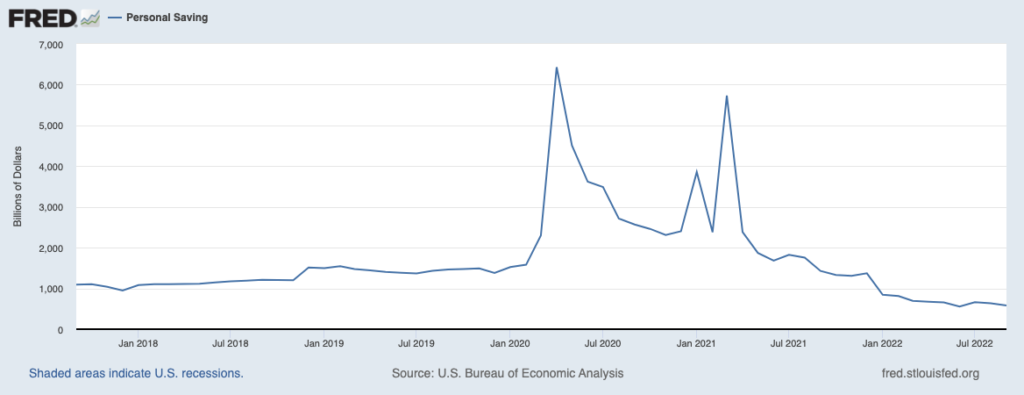

Are Households Starting to Tap Out? American households stockpiled savings at a record rate in the year following the pandemic. The stockpile is starting to shrink – according to government data, somewhere between $1.2 and $1.8 trillion in savings remain, which is a far cry from the near $6 trillion level reached in the months following the pandemic when the first stimulus checks started to arrive. Many economists expect what’s left of savings to run out possibly in nine to twelve months. Households have been saving less and tapping into reserves to meet the inflation moment. In 2020, the household savings rate was 8.8% as households had fewer opportunities to spend, but the rate has since fallen to 11.8% in 2021 and down to 3.1% now – the lowest level since the 2008 Global Financial Crisis.3

To make up for some of the shortfalls, households have been picking up more debt, a trend worth watching. According to the Federal Reserve Bank of New York, credit-card balances have risen by 15% year-over-year in Q3 2022, which is the fastest pace of increase in 20+ years. The percentage of credit card balances more than 30 days past due also rose. This inflation-induced stress on households could be made worse if the labor market starts to loosen and more layoffs appear.

What Do Americans Dislike More, Inflation or Unemployment? Such is the question of the so-termed “Misery Index,” which for 50 years has been a napkin math barometer for how Americans felt about the economy. The origins of the Misery Index go back to an economist in President Lyndon Johnson’s White House, named Arthur Okun. His formula for the Misery Index was simple: just add the unemployment rate with the inflation rate and you have the metric. But more recently, economists have begun to rethink the one-for-one relationship between unemployment and inflation, i.e., the fact that Americans may not loathe them equally. As it turns out based on polling and surveys, Americans dislike unemployment more than they do inflation, such that a 1% increase in unemployment is about as undesirable as a 2% change in inflation. Sentiment surveys clearly show that many are unhappy with the state of the economy, just not as unhappy as previously thought given the ongoing strength in the labor market.5

Overcoming Market Volatility – Some investors tend to panic and sell out of the market when volatility takes the wrong turn.

It is impossible to avoid volatility, but there are ways you can minimize the worst impacts of a volatile market. In our newest guide, ‘The Do’s and Don’ts of Stock Market Volatility’ we provide recommendations for investors, based on 30 years of expertise. We also explore:

- 3 best practices to successfully manage periods of market volatility

- 3 most common mistakes investors make, and why they are so damaging to your long-term investing goals

- Historical data that supports our conclusions and underscores the recommendations we propose

If you have $500,000 or more to invest, get our free guide today!

Disclosure

1 Wall Street Journal. August 23, 2022. https://www.wsj.com/articles/some-of-the-best-holiday-gift-deals-are-popping-up-before-labor-day-11661212669?mod=article_inline

2 Zacks Investment Management reserves the right to amend the terms or rescind our free The Do’s and Don’ts of Stock Market Volatility offer at any time and for any reason at its discretion.

3 Wall Street Journal. November 20, 2022. https://www.wsj.com/articles/as-savings-slowly-shrink-consumer-spending-is-on-borrowed-time-11668956403?mod=djemRTE_h

4 Fred Economic Data. October 28, 2022. https://fred.stlouisfed.org/series/PMSAVE#

5 Wall Street Journal. November 18, 2022. https://www.wsj.com/articles/inflation-and-unemployment-both-make-you-miserable-but-maybe-not-equally-11668744274?mod=djemRTE_h

6 Zacks Investment Management reserves the right to amend the terms or rescind our free The Do’s and Don’ts of Stock Market Volatility offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.